Weekly Mortgage Rate Update (September 7th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

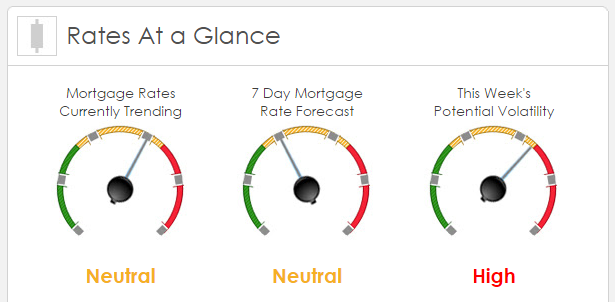

Rates Currently Trending: Neutral

Sigma Research said rates are trending slightly worse this morning. Last week the MBS market improved by +16 bps. This was probably not enough to affect rates or fees. The market was moderately volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research the MBS market continues to trade in a very tight range with a good deal of volatility. Until it’s clear when the Fed is going to increase rates the mortgage rate market will continue to move sideways.

President John Williams said on Friday; “All of the data that we have had up until now has been, I think, encouraging. It has been about as good, or better, than I was expecting, in terms of the U.S. economy,”…… “But there are some pretty significant — and I would say have now grown larger — headwinds that have developed.” Bottom-line, markets are fixated on what the Fed will do, and what will be said by Yellen at her press conference. Will markets be damaged if the FOMC does increase the FF rate? Given the constant drumbeat of concern the take away is underlying fears that the economy will suffer; we don’t agree, a rate increase should not have as much impact as is being painted.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week. We sound like a broken record from week to week, but until the market receives a clear reading from the Fed we’ll continue to see high volatility from day to day. However, we don’t expect the mortgage rates to move dramatically one way or the other until the Fed acts.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.