Weekly Mortgage Rate Update (September 18th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

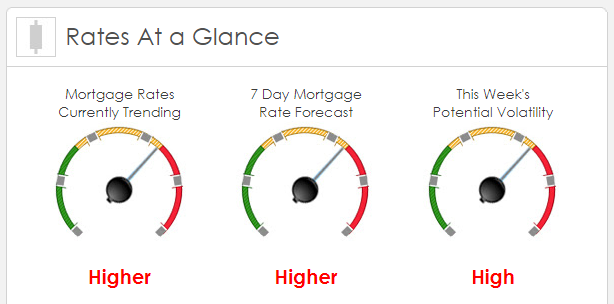

Rates Currently Trending: Higher

Mortgage rates are trending slightly higher this morning. Last week the MBS market worsened by -57 bps. This was enough to worsen mortgage rates or fees. Mortgage rates experienced relatively low volatility after the first part of the week.

This Week's Rate Forecast: Higher

Three Things: These are the three things that have the greatest ability to impact mortgage rates this week: 1) Fed, 2 ) Geopolitical and 3) Japan

1) Fed: The Federal Open Market Committee (FOMC) will start their policy meeting on Tuesday and conclude on Wednesday with their 2:00 EDT release of their interest rate decision and policy statement. The bond market currently has almost no chance of a rate hike at this meeting but has recently moved up their probability from 30% to 51% for a potential rate hike in December.

The bond market will be paying very close attention to any new hints or even actual policy on their massive balance sheet that has been used to keep a tight lid on interest rates by gobbling up Treasuries and MBS at a pace that a true open market could never support. Even the most “dovish” Feds have expressed the need to address the issue. They have outlined a plan in the past where they still buy Treasuries and MBS but at a slower pace while allowing maturing notes and bonds to roll off the balance sheet instead of reinvesting the principal in new purchases. We even have seen timelines from them…but will this meeting be the meeting that they start it or give us an official start date. That is the major focus for bond traders this week. We also get a live press conference with Fed Chair Janet Yellen at 2:30EST to explain their new policy.

Feds this Week:

- 09/19 – Start of FOMC Meeting

- 09/20 – Interest Rate Decision and Policy Statement, live press conference with Janet Yellen

- 09/22 – John Williams, Esther George and Robert Kaplan speak. We also get the Atlanta Fed Business Inflation expectations.

2) Geopolitical: The focus this week will be on the United Nation’s meeting in New York. President Trump will speak at the event. The U.N. voted last week to increase sanctions against North Korea which has not, as of yet, had the desired effect as N.K. fired another missile over Japan last week. The bond market will also react to any significant movement in policy over Tax Reform.

3) Japan: The Bank of Japan will be in the spotlight as we hear from their Central Bank on Thursday. We will get their interest rate and policy statement. The market is not expecting a change but will focus on forward guidance.

Location: We get a lot of housing industry news this week.

- 09/18 – Home Builders Sentiment Index

- 09/19 – New Home Starts and New Building Permits

- 09/20 – Existing Home Sales

- 09/21 – FHFA Home Price Index

This Week's Potential Volatility: High

We expect mortgage rates to be relatively flat with low volatility until Wednesday’sinterest rate decision. While the Fed is unlikely to move rates, their comments could move mortgage rates and cause market volatility.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.