Weekly Mortgage Rate Update (September 14th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

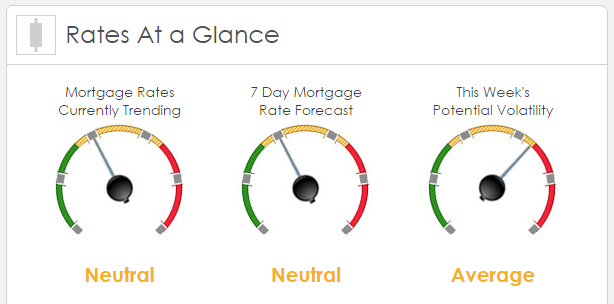

Rates Currently Trending: Neutral

Sigma Research said that rates are slightly better this morning. Last week the MBS market worsened by -35 bps (worse rates). This was probably enough to affect rates or fees. The market was relatively calm last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research generally quiet this morning with no domestic economic data and the FOMC meeting this week. Should be less volatile going into Thursday’s policy statement. No consensus on what the FOMC will do, there is however a little more increase in the view that the Fed should do it, increase the Federal Funds rate now by 0.25%. Probably because the uncertainty has driven investors, traders and analysts crazy over the last 60 days trying to divine what will happen and what the markets reactions will be, domestically and internationally. The IMF and the World Bank want the Fed to hold off, being concerned about the impact to emerging markets as the dollar would increase further harming global markets. Will Yellen defy the IMF and World Bank; does it make any difference? The Fed has another opportunity again after not moving earlier this year; not moving now the Fed might miss another opportunity until next year. In the end, for all of the talk this week there isn’t going to be much of a consensus.

The most current view about the FOMC; 46% of economists surveyed by The Wall Street Journal in September expect the Fed to raise rates this week, compared with 82% in an August survey. One major firm that expected the Fed to move now has changed its outlook to March 2016. As the clocks clicks down the consensus view is the Fed will delay. Given big money expects no increase Thursday it adds more concern for the Fed to not roil markets and bend to the narrow consensus. US unemployment is declining, there are members of the FOMC see that as a reason to move now, ignoring the recent volatility in global markets. Some Fed officials worry that not moving now will add to the unsettled conditions with the rate hike continuing to hang precariously over markets.

This Week’s Potential Volatility: Average

According to Sigma Research the risk for volatility is average today and this week. Thursday is the day the markets could really see some volatility as the Fed will release their policy statement. As noted above, the markets do not have a clear notion of what the Fed will do with rates, increasing the likelihood of a big swing in mortgage rates toward the end of the week.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.