Weekly Mortgage Rate Update (October 5th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

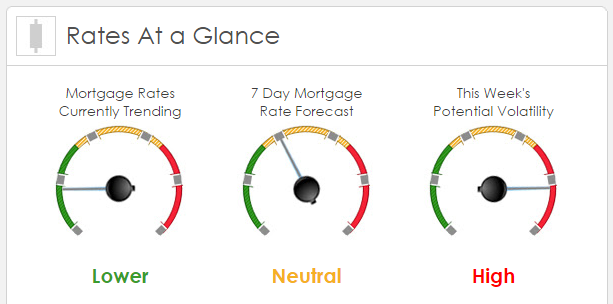

Rates Currently Trending: Lower

Sigma Research says that rates are trending worse this morning. Last week the MBS market improved by+56 bps. This was probably enough to affect rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research last Friday’s employment report was not good in terms of jobs, Sept jobs were much lower than expected and August and July reports on jobs were revised lower. Initially the stock market took it hard, the DJIA dropped 260 points and interest rates dropped as money moved to safety. The 10 yr note yield Friday morning declined to 1.91% as stock indexes crumbled. That was in the morning, in the afternoon stocks reversed and launched a strong rally; the range in the DJIA the widest in four years (460 points from highs to lows). This week is thin on economic measurements, Treasury will auction $ 58B of notes and bonds. The FOMC minutes from the Sept meeting will be released on Thursday. Boston Fed’s Eric Rosengren on the possibility of a rate hike this year: “We’ll have to see whether the (Sept) employment report was a little anomalous or whether it turns out to be more of a broader pattern,”…… “If this is an anomalous report then, if the data came in sufficiently, I would be comfortable possibly raising rates by the end of the year,”….. “I think the real question is whether the domestic economy offsets some of the headwinds we’re seeing from the international sector.”

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week. Last week was a wild one capped off by the weak employment numbers. We’re expecting a less volatile week this week, but also expect some surprises.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.