Weekly Mortgage Rate Update (November 9th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

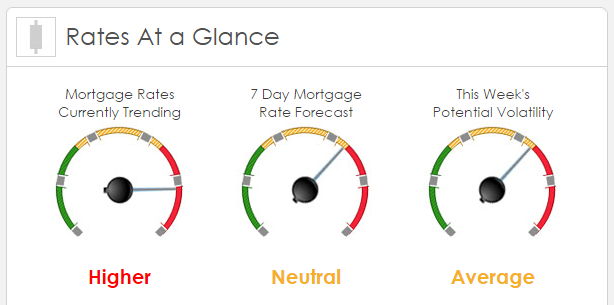

Rates Currently Trending: Higher

Sigma Research said that mortgage rates are trending slightly worse this morning. Last week the MBS market worsened by -57 bps. This was enough to affect rates or fees. Last week was fairly calm until Friday’s employment report came in much stronger than expected.

This Week’s Rate Forecast: Neutral

According to Sigma Research rate markets still trading on the strong October employment report last Friday. Friday saw MBS prices decline 45 bps and the 10 yr yield increase 10 bps to 2.33% the highest yield since mid-September. Strong job gains (+271K), average hourly earnings twice as strong as forecasts (+0.4%), U-6 at 9.8% the lowest since May 2008 (less people working at part time or jobs less than workers want). No matter how you look at it the October employment data was much better than expectations and has elevated the prospect of the Fed increasing the FF rate in Dec. Still a lot of measurements between now and Dec, including the November employment data, but markets presently now believing a rate hike in Dec. It will take a huge reversal in the economic data now to dissuade the Fed from not moving in Dec.

Over the last two weeks the yield on the 10 yr note has increased 36 bps as of 9:30 this morning and mortgage rates up 20 basis points in rate. Almost daily now the 10 yr treasury note is easily braking numerous technical levels, not even hesitating. All of the long positions and negative economic outlooks disappearing driven recently by the October employment report last Friday. The report showed the strongest yearly wage gains since 2009 and the lowest unemployment rate in more than seven years. Looks now like there is no stopping the Fed unless November employment falls substantially. Other data though between now and then can keep markets guessing.

This Week’s Potential Volatility: Average

According to Sigma Research the risk for volatility is average today and this week. Not a lot of big news coming out this week to move the mortgage rate market. Hoping the mortgage rate market will begin to stabilize.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.