Weekly Mortgage Rate Update (November 30th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

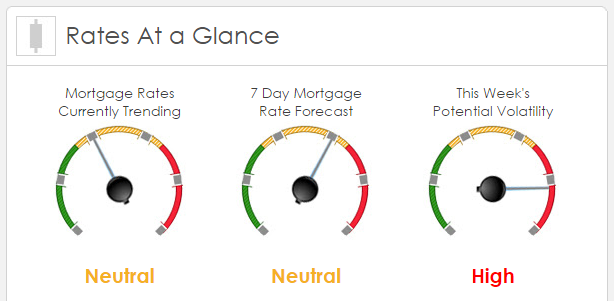

Rates Currently Trending: Neutral

Sigma Research says that rates are trending worse this morning. Last week the MBS market improved by +13 bps. This was not enough to affect rates or fees. There was low volatility last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research this is the week markets have been anticipating for a month. Friday the Nov employment report along with other key reports and Fed officials out like ants on a sugar cube led by Janet Yellen. By the end of the week there should be no more speculation about what the Fed will do when the FOMC meets on Dec 15th and 16th about increasing interest rates. Since that very strong Oct employment report that shocked with 271K job growth the expectation of the lift-off increased; the idea being that unless the Nov employment report was an equally weak report as the Oct was strong, the Fed will have what it needs to make the move.

Global data: Japan; industrial production rose 1.4% m/m in October according to preliminary data. The reading missed economists’ expectations but beat the 1.1% gain from September. Retail sales jumped a better-than-expected 1.8% in the year to October after declining 0.2% y/y in September. German retail sales unexpectedly dropped 0.4% m/m in October (2.1% y/y) after remaining unchanged in September (3.5% y/y). Italy’s consumer price index fell 0.4% m/m in November, according to an initial estimate. Economists had been forecasting a smaller decline and the CPI actually rose 0.2% m/m in October. UK mortgage lending expanded by a greater-than-expected 3.60B £ in October, the same as it had in September.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility this week. The mortgage markets are neither bullish or bearish; building a pattern of very tight ranges that is likely to set off a big move later this week.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.