Weekly Mortgage Rate Update (November 16th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

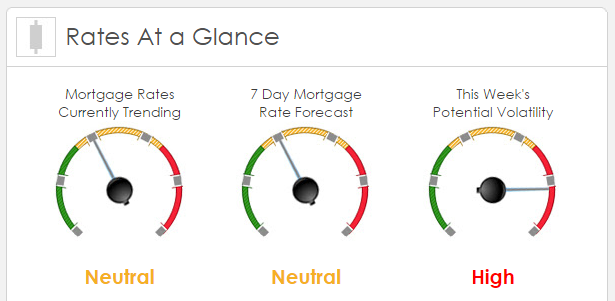

Rates Currently Trending: Neutral

Sigma Research says that rates are trending slightly better this morning. Last week the MBS market worsened by -12 bps. This was may’ve been enough to affect rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research the savage attacks in Paris Friday night by ISIS clearly escalate the terror that Europe will feel for a long time to come. Will the attacks have a major impact on the EU economy, will the US actually respond with a major effort? Two questions that presently are being debated around the world. That the attacks happened on Friday evening has kept markets generally settled; had those attacks happened during the week we would have momentary chaos in markets. This morning the markets began relatively calm, here and in Europe; stocks starting quietly, the bond and mortgage markets also stable.

Right out of the gate this morning the financial media has leaped in with the question; will the terrorist attacks in Paris keep the Fed from increasing interest rates that is widely expected? Until Friday evening the only potential impediment to a rate increase was the Nov employment report due on Dec 4th. Now another layer to consider; if the US were to add more troops in Syria or in any way become deeply involved the Fed would likely pass on an increase. A huge unknown presently, and the US has not shown much interest in escalating our involvement, just a smattering of commitments. The bond and mortgage market a little better this morning; as we noted last week we expect some improvements in the rate markets.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week in part due to the attacks in Paris. The biggest event that could cause volatility this week is Wednesday’s release of the minutes from the last FOMC meeting.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.