Weekly Mortgage Rate Update (May 8th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

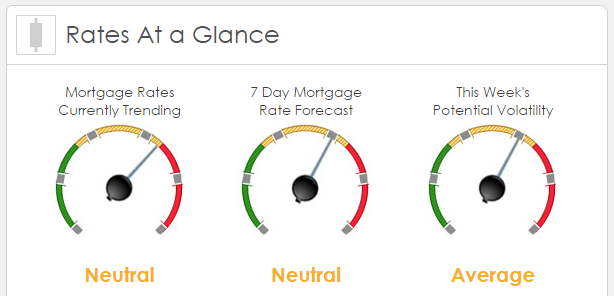

Rates Currently Trending: Neutral

Mortgage rates are moving sideways to slightly worse so far today. The MBS market worsened by -13 bps last week. This may’ve been enough to worsen mortgage rates or fees. The market experienced moderate volatility last week.

This Week's Rate Forecast: Neutral

1) Domestic Flavor: This is week is another back loaded week, but we have some very heady economic reports that will hit. Of note is Thursday and Friday’sInflationary data with PPI and CPI. CPI has been over 2% YOY the last couple of readings, and this will be watched closely. Retail Sales will be the biggest report.

2) Fed: After last week’s seemingly hawkish FOMC policy and Friday’s jobs data, the bond market will play close attention to their collective commentary this week:

- 05/08 James Bullard,Loretta Mester

- 05/09 Eric Rosengren, Robert Kaplan

- 05/10 Eric Rosengren

- 05/11 William Dudley

- 05/12 Charles Evans, Patrick Harker

3) Across the Pond: Now that the French Election is over, the markets are focusing on if President Macron can get a cabinet together and who will be the Prime Minister. Great Brittan will have an important BofE meeting. They will be the first Central Bank to be able to make policy without being forced to be on hold pending the French election and the future of Europe.

WTI Oil prices will also need to be closely watched as they have been providing terrific support for our pricing and Russia/Saudi Arabia are doing their best to prop up pricing this week.

This Week's Potential Volatility: Average

Now that the French election is over and it went as expected look for a pullback in the MBS market (higher rates). We’re not looking for anything too dramatic given the significant amount of support we have in the MBS market. As noted above, Thursday and Friday could be volatile days whereas the rest of the week we’re expecting less volatility.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.