Weekly Mortgage Rate Update (May 30th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

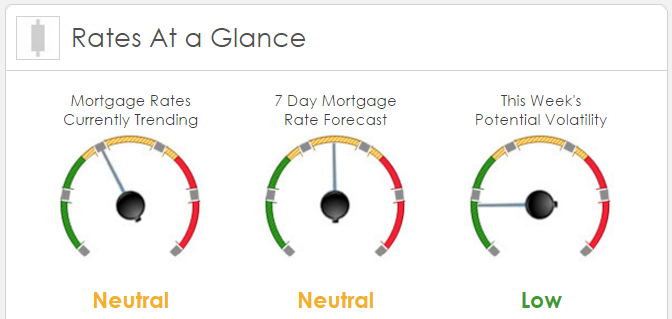

Rates Currently Trending: Neutral

Mortgage rates are trending unchanged this morning. Last week the MBS market improved by +2 bps. This was not enough to improve mortgage rates or fees. The MBS market was fairly calm last week.

This Week’s Rate Forecast: Neutral

The week has very significant data, culminating with the May employment dataon Friday. In the meantime both ISM indexes, personal income and spending, consumer confidence index, construction spending, factory orders and the Fed’s Beige Book. At 9:45 May Chicago purchasing mgrs. index, expected at 50.7 from 50.4 in April; as reported down to 49.3, under 50 indicates contraction. The reaction should support MBS prices, although the initial reaction was muted with no immediate reaction to the weaker index. It is a regional report, tomorrowmarkets will get a national reading when the ISM manufacturing index is released. The final economic data today, May consumer confidence from the Conference Board, expected 97.0 from 94.2; as reported 92.6 with April revised slightly higher to 94.

This Week’s Potential Volatility: Low

The volatility today and this week should be relatively low until employment on Friday. We’re at very important levels for mortgage rates any significant move downward in the MBS could be a sign for a medium term upward trend in mortgage rates.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.