Weekly Mortgage Rate Update (May 23rd, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

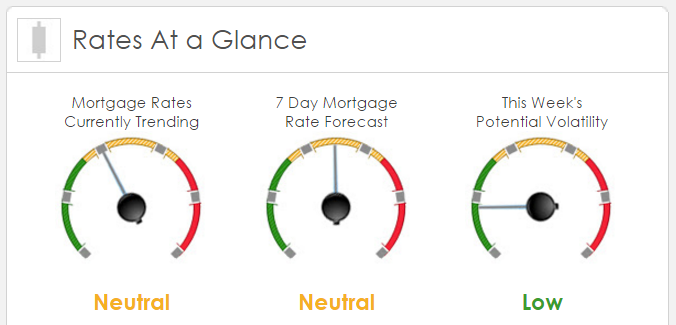

Rates Currently Trending: Neutral

Mortgage rates are trending unchanged this morning. Last week the MBS market worsened by -53 bps. This was enough to worsen mortgage rates or fees. The MBS market was volatile in the beginning of last week and calm toward the end of the week.

This Week’s Rate Forecast: Neutral

Here are the three items that bond traders will be watching very closely this week 1) Yellen, 2) Economic Data and 3) MBS sales.

Yellen: She will speak at Harvard on Friday as they present her with an award. The ranks of the other Talking Feds has been very clearly pro-rate hike but she has been seen as more dovish. The markets will be watching intently to see if she appears to be shifting her bias as they will take that as a signal that a rate hike is coming.

Economic data: The two biggest reports this week are Durable Goods and GDP. The Durable Goods are expected to see a very nice improvement (ex autos) while the first print of the first QTR GDP is expected to be revised upward. Fed starts to dump MBS. They will be “test” selling some of their vast MBS holdings on Wed. They have been a major purchaser every week, eating up supply but on Wed they will start to sell…$120M

This Week’s Potential Volatility: Low

We’re not looing for much of a move in mortgage rates this week. Wednesday will be interesting with the Fed selling MBS as its not something that we’ve seen before.Friday’s speech by Yellen is probably the most significant event as we will see if she continues the trend of “hawkish” commentary by every other Fed official. But essentially, mortgage rates are on pause as we’re awaiting next week’s OPEC meeting and the ECB’s policy statement.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.