Weekly Mortgage Rate Update (March 6th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

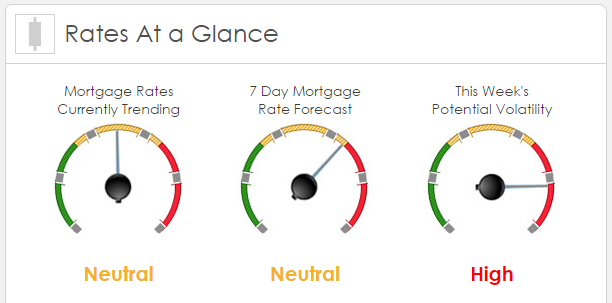

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market worsened by -90bps. This was enough to worsen mortgage rates or fees. Mortgage rates were volatilie last week.

This Week's Rate Forecast: Neutral

Three Things: These three things have the greatest ability to impact mortgage rates this week: 1) Jobs. 2) Geo-Political and 3) Across the Pond.

1) Job: Yellen and crew made it very clear (and the markets actually listened after the exact same message for three straight weeks) that they are on track for a March rate hike provided that the economy continues on its current path. After last week’s block buster manufacturing, services, and Consumer Sentiment reports, only one thing stands in the way between now and next week’s FOMC meeting and that is Big Jobs Friday. We will get the Unemployment Rate and the Non-Farm Payroll data but the bond market will be focused on the Average Hourly Wage data. Any monthly reading at or above 0.2% or a year-over-year reading at or above 2.5% will “seal the deal” in the market’s minds of a rate hike next week.

2) Geo-Political: We are supposed to get a revised travel ban/immigration order this week that will exempt green card holders and Iraq. But more importantly, the GOP is supposed to release their Obama Care fix. The key with that is what tradeoffs will they make in terms of tax policy (as far as bonds are concerned).

3) Across the Pond: The European Central Bank will have their policy statement and interest rate decision on Thursday and It will be interesting to see how their bias changes given that our Fed is poised to raise rates. The bond market is keen to know that that influences their asset purchase program, etc. This also goes to the unclean political future of the leadership of German, France, Italy and Spain with a few of those countries potentially leaving the Eurozone.

China: The People’s Bank of China (PBOC) will have their key interest rate and policy statement and we will also get key economic data like CPI this week.

Japan: We will get an important GDP release this week.

This Week's Potential Volatility: High

This is a pivotal week. The biggest domestic event is Friday’s Average Hourly Data. If it is at 0.2% or above, the MBS market will more fully price in a rate hike next week. But until Friday, MBS will be reacting to the Chinese and ECB rate decisions. From a technical perspective, MBS are still “treading water” just above a significant support level. We expect a volatility this week due to the important data denoted above.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.