Weekly Mortgage Rate Update (March 27th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

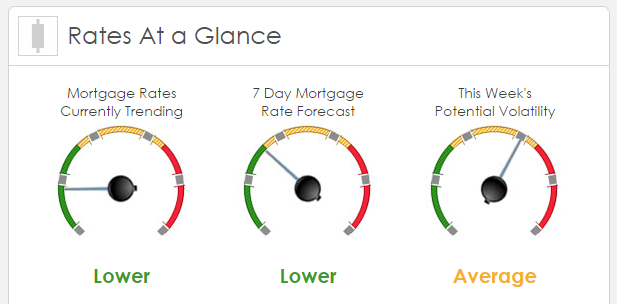

Rates Currently Trending: Lower

Mortgage rates are trending lower this morning. Last week the MBS market improved by +41bps. This was enough to improve mortgage rates or fees. Mortgage rates experienced moderate to low volatility.

This Week's Rate Forecast: Lower

Three Things: Here are the Three Things that have the greatest ability to impact mortgage rates this week. 1) Taxes, 2) Fed and 3) PCE.

1) Taxes. Health Care reform was an epic fail. The concept of a Republican controlled White House, Senate and House rubber stamping legislation and pushing through needed changes is narrowing and has traders walking back their expectations of regulatory reform, tax reform and infrastructure spending. This week, we will get a lot of talk regarding Tax Reform…IF it appears that it is going to be the same as Health Care, then MBS will continue to see support. IF it appears that it will move through the House, then MBS will sell off.

2) Fed: We have another big week in terms of the number of speeches:

- 03/27 Charles Evans, Dennis Kaplan

- 03/29 Eric Rosengren and John Williams

- 03/30 Loretta Mester, Dennis Kaplan and William Dudley

- 03/31 Neel Kashkari and James Bullard

3) PCE: The most important domestic economic release this week won’t hit until Friday. The Personal Consumption Expenditures release is what the Fed looks at then they say they have a target rate of inflation of 2%. They look at the YOY (year-over-year) reading and not the monthly reading. Last time, the YOY reading was at 1.9%. This report will also contain important Personal Income and Spending data.

Treasury Auctions this week:

- 03/27 2 year note

- 03/28 5 year note

- 03/29 7 year note

This Week's Potential Volatility: Average

Mortgage rates are headed lower on the heals of the fall of the health care bill. Markets will shift focus to the administrations ability to implement meaningful tax reform. We expect periodic volatility as the markets determine if reform is possible.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.