Weekly Mortgage Rate Update (June 6th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

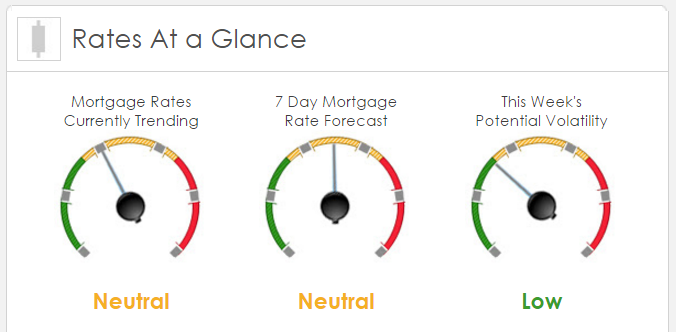

Rates Currently Trending: Neutral

Mortgage rates are trending slightly worse this morning. Last week the MBS market improved by +67 bps. This was enough to improve mortgage rates or fees. The MBS market was fairly calm last week until Friday’s move toward lower mortgage rates.

This Week’s Rate Forecast: Neutral

Here are the top three events that have the greatest ability to impact mortgage rates this week: 1) Janet Yellen, 2) Oil and 3) Consumer Credit.

Yellen: She will actually speak twice today (12:30 and 2:00 ETS). The Fed will enter their “black out” period (which means no Talking Feds for one week before the Fed meeting) afterwards. The market wants to see if she down plays the miss in NFP due to seasonality, etc and if she thinks its more of a “one off” or part of a trend. If she downplays it, bond traders will think that July is still possible. If she expresses deep concern, then the bond market will scrap July and focus on September for the next rate hike.

Oil: Oil sold off last week as the OPEC meeting yielded nothing. But this week, WTI is in positive territory on supply disruptions out of Nigeria and comments out of Saudi Arabia that supply could be falling due to increased demand.

Consumer Credit: Normally, this would not be in the top three but we do have a very light week for economic data. This is really a proxy for Consumer Spending and we will want to strip out auto and student loans to see the increase in revolving debt. The higher revolving debt is, the more consumers are spending which may lead to a stronger retail sales report.

This Week’s Potential Volatility: Low

Not a lot of market moving news this week as noted above. We had a big improvement last week in mortgage rates. We don’t have any planned economic news that will push us to lower rates and conversely no planned news to push us to higher rates. As a result, we’ll be keeping a closer eye than normal on oil prices.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.