Weekly Mortgage Rate Update (June 13th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

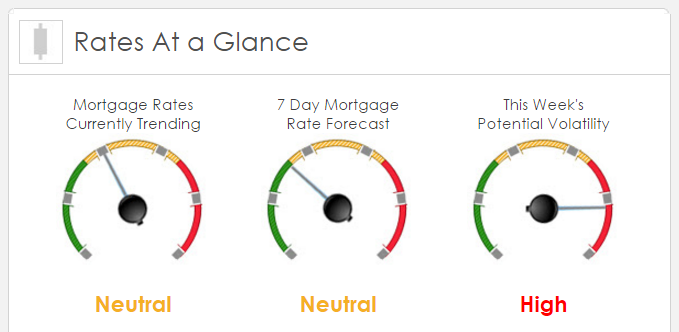

Rates Currently Trending: Neutral

Mortgage rates are trending unchanged this morning. Last week the MBS market worsened by -7 bps. This was probably not enough to worsen mortgage rates or fees. The MBS market was fairly calm last week.

This Week’s Rate Forecast: Neutral

The Big Three: Here are the three items that bond traders will be paying very close attention to this week 1) Brexit, 2) Fed Policy Statement and 3) Retail Sales.

1) Brexit: This is the number one force in our elevated pricing this month. The bond market will be reacting in lock-step with polling data. The higher the “leave” vote is in the polling data, the better it is for your pricing.

2) Fed: The bond market has September pegged as the next time the Fed will move with another rate hike but its clear the data is there for one in June or July. Everyone (including many vocal Fed voters) have said that they their hands are tied prior to the Brexit vote, so June is out. But we will be paying very close attention to their Economic Projections and Dot Plot Chart which aggregates each FOMC member’s own internal projection on future interest rates. We also get a live press conference with Janet Yellen.

3) Retail Sales: We actually have a very big week for economic data but Retail Sales will get the most weight. Consumer Credit was disappointing and Consumer Sentiment seems flat which would point to a lack-luster report, but wages are up and that could point to a strong report.

This Week’s Potential Volatility: High

Expect increased volatility and not much change in the bond and mortgage markets now until the FOMC and Yellen’s press conference on Wednesdayafternoon.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.