Weekly Mortgage Rate Update (July 4th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

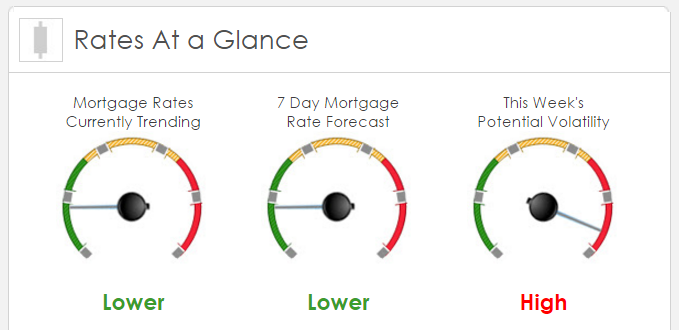

Rates Currently Trending: Lower

Mortgage rates are trending lower this morning. Last week the MBS market improved by +67bps. This was enough to improve mortgage rates or fees. The MBS market was very volatile last week.

This Week’s Rate Forecast: Lower

The Big Three: The following three events will have the most impact on MBS pricing this week 1) Central Bank Palooza, 2) Jobs and 3) ISM.

1) Central Bank Palooza: We open this week’s trading session with the Bank of England’s Governor Mark Carney making some policy moves. He dropped the capital buffer rate for their banks down from 0.5% t0 0.0%. This means that they have to hold less capital in reserves and will presumably lend it out to businesses to provide some economic momentum. ECB: They have a non-monetary policy meeting on Wednesday but the markets will be paying close attention to ECB President Mario Draghi’s speech. The Talking Fed: We will get the minutes from the last FOMC meeting on Wednesday. This is not likely to be a big market mover though as this meeting was before the Brexit vote and all we will find out is that the Fed was not willing to make a move with that unknown hanging over their heads. So, instead the market will be focusing on post-Bexit commentary from this week’s Talking Feds: 07/05 William Dudley 07/06 William Dudley, Daniel Tarullo.

2) Jobs: We have a glut of jobs related data this week which include ADP Private Payrolls, Challenger Job Cuts, Initial Jobless Claims, Continuing Claims, Non-Farm Payrolls, Unemployment Rate and Average Hourly earnings. The bond market will focus the most on Avg. Hourly Earnings as the last reading showed a 2.5% YOY gain. Of interest will also be the revision to last month’s laughably inaccurate release of 38K.

3) ISM Non-Manufacturing: We saw some very robust manufacturing data last week (Chicago PMI and ISM) but that only represents about 20% of our economy. This week’s ISM Non-Manufacturing report address the services sector which accounts for the biggest part (80%) of our economy. The market is expecting a strong reading.

This Week’s Potential Volatility: High

Markets and many economies, as noted above, are still reeling from the Brexit vote. This is helping to fast forwarding much of the weakness already embedded in the EU economy. Once again we’ll be looking for a very volatile mortgage rate marketing.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.