Weekly Mortgage Rate Update (July 25th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

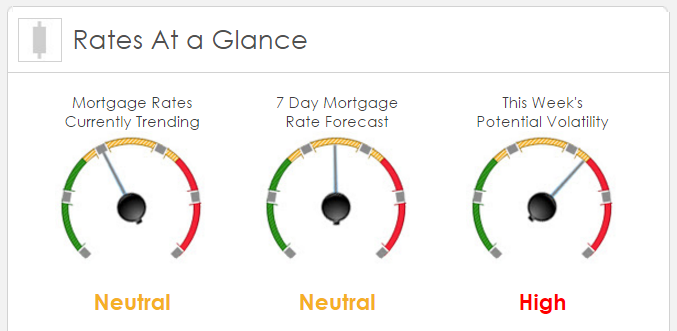

Rates Currently Trending: Neutral

Mortgage rates are trending unchanged this morning. Last week the MBS market worsened by -9 bps. This was probably not enough to worsen mortgage rates or fees. The MBS market was fairly calm last week.

This Week’s Rate Forecast: Neutral

Three Things: The following three items have the largest potential to move pricing for MBS. 1) The FOMC rate decision, 2) 2nd QTR GDP Data and 3) Bank of Japan.1) The Federal Open Market Committee (FOMC) will conclude two days of meetings on Thursday and give us the interest rate decision and policy statement. The markets are not expecting any movement at this meeting but are looking to see if it still looks like we are on track for at least one rate hike this year. It will be interesting to see their comments now that the Brexit vote has occurred and our own strong domestic data. 2) GDP. We get our first glimpse of the preliminary 2nd QTR GDP and the market is expecting a very high reading of over 2.50%. The Fed has said several times that they will make their policy decisions based upon the strength of the 2nd QTR, so this is very key. 3) BofJ. Thursday’s Bank of Japan meeting is also critical. The markets expected both the Bank of England and the ECB to lower their rates this month and neither happened. The bond market is also expecting more easing from the BofJ, the size and scope of which will have a big impact on all of the markets.

This Week’s Potential Volatility: High

Unlike last week, this week we have a lot of economic data that could move mortgage rates out of this tight channel. We’ll be keeping a very close eye on the above and other mortgage rate moving news.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.