Weekly Mortgage Rate Update (July 18th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

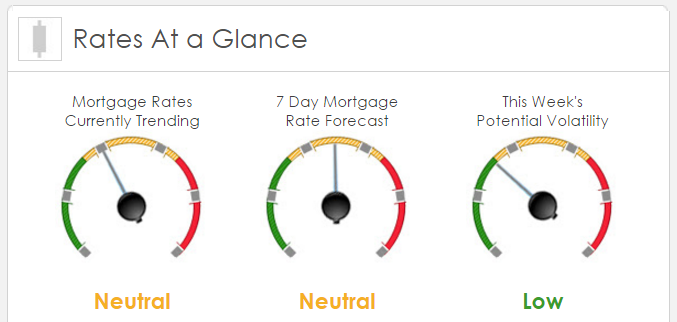

Rates Currently Trending: Neutral

Mortgage rates are trending unchanged this morning. Last week the MBS market worsened by -52 bps. This was enough to worsen mortgage rates or fees. The MBS market was fairly volatile last week.

This Week’s Rate Forecast: Neutral

We have a very light week for economic data, no Treasury auctions and no Talking Feds. Three Things: These three items will get the most attention from long bond traders: 1) ECB Interest Rate Decision, 2) Geo-political and market fallout from Turkey, 3) Brexit news.

1) Thursday’s European Central Bank rate decision has the greatest potential to create volatility as its the first one since the Brexit vote. They could cut their rate or drive their deposit rate even more negative than it is or announce more asset purchases. Or they can do what the BofE just did…..nothing.

2) Turkey – this is really an oil play as so far as there are no disruptions of the flow of oil as they have a major pipeline there. But any spike in violence there could start to impact prices.

3) The bond market “cooled” a tad last week as the new PM, Bexit Czar and other cabinet positions were filled and removed some of the “unknown”. Further progression on this front could continue to remove some of the “fear factor” premium in MBS.

Housing: We have a lot of housing data this week with the Home Builders’ Sentiment, Mortgage Applications, Housing Starts, Building Permits, FHFA House Price Index and Existing Home Sales. The later will get the most attention. At the end of this week, we will have a very good idea of how our housing market is doing but it will have very little impact on mortgage rates.

This Week’s Potential Volatility: Low

Today is likely to be quiet, no news expected that would move financial markets. As for the week, we also expect low volatility given the lack of impactful financial news due out.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.