Weekly Mortgage Rate Update (January 4th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

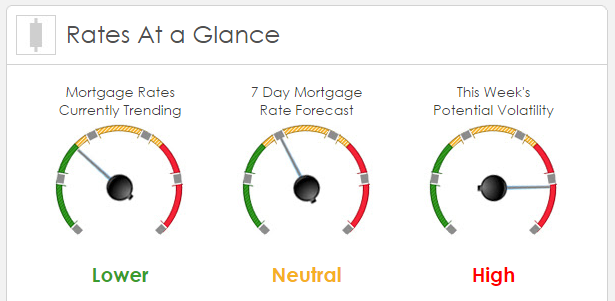

Rates Currently Trending: Lower

Sigma Research says that rates are trending slightly worse this morning. Last week the MBS market improved by +20 bps. This may’ve been enough to affect rates or fees. The market was moderately volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research global equity markets taking huge hits this morning to get the year underway. China’s manufacturing index unexpectedly dropped sending the Shanghai Composite down 7.00% setting off trading curbs. The Manufacturing PMI unexpectedly fell to 48.2 for December from 48.6 in November, the 10th month in a row China’s manufacturing has declined. Yesterday Saudi Arabia broke off all relations with Iran over the Saudi’s execution of 47 terrorists and Iranian protesters firing the Saudi embassy in Tehran. Two incidents that are starting the year with high concerns in mid-east increasing tensions and China’s economic outlook more dire than what the Chinese government is forecasting.

These are the three events we’ll be keeping an eye on this week that could affect mortgage rates. 1) Non-Farm Payroll report (Jan 8th) , specifically the Average Hourly Wages, 2) The minutes from the last Fed meeting (Jan 6th) where they announced a rate hike and 3) Continued weakness overseas (oil, and China).

This Week’s Potential Volatility: High

According to Sigma Research volatility will start to increase this week now that the holiday is over. However, mortgage rates continue to stay in a very tight range and we’ll need to have a trend in positive or negative economic news to pull us out of the channel.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.