Weekly Mortgage Rate Update (January 30th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

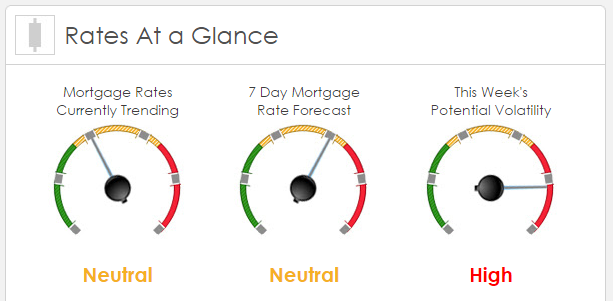

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +2 bps. This was not enough to improve mortgage rates or fees. While the improvement in the MBS market (mortgage rates) the was very tame, mortgage rates experienced a good deal of volatility for the week. The MBS market had an intra-week swing of 96 bps from our highs to lows.

This Week's Rate Forecast: Neutral

Three Things: These three things have the greatest ability to impact mortgage rates this week as they will drive MBS trades. 1) Trump 2) The Fed and 3) Domestic.

1) Trump: He signed 17 Executive Orders in his first week. Now that we enter week 2, there will be more. Of importance is how he handles work visa programs that the technology sector relies heavily on. His comments and policies will have the largest impact on pricing. He has already signed an Executive Order this morning regarding regulations that is aimed at making it easier for small businesses to start up and operate with less red tape.

2) The Fed: On Wednesday we get their first action of the year. Their policy statement and interest rate decision will have a big impact on mortgage rates. However, the market is currently betting that nothing will happen at this meeting. Mostly because this is one of the meetings where there is no live press conference with Janet Yellen. While it very well may be that the Fed does not move to tighten again so soon after raising rates in December it’s a big mistake by pundits and traders to assume that no action can be taken absent a press conference as we have seen rate hikes announced in between Fed meetings before. This meeting is interesting as we usher in a new group of voting members that did not have a vote last year.

3) Domestic: The market will of course focus on Big Jobs Friday where we get our Average Hourly Wages (currently up 2.9% YOY), Non-Farm Payrolls and the Unemployment Rate (currently 4.7%). But there are plenty of other big name releases this week with the gravitas to move mortgage rates. These include Chicago PMI, ISM Manufacturing and ISM Services.

The Bank of Japan (BofJ) will have their policy statement, interest rate decision and economic forecast on Tuesday.

China starts out the week with their Chinese New Year but Wednesday we get a very important data set with both Manufacturing and Services PMI.

The Bank of England (BofE) will have their policy statement, interest rate decision and Minutes on Thursday.

This Week's Potential Volatility: High

Between President Trump’s actions and the heavy economic data week, we expect mortgage rate volatility to be very high this week.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.