Weekly Mortgage Rate Update (January 23rd, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

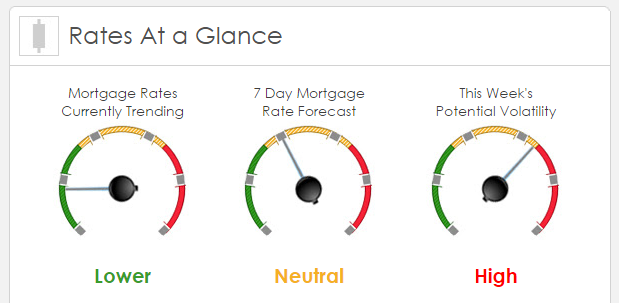

Rates Currently Trending: Lower

Mortgage rates are trending lower this morning. Last week the MBS market worsened by -79bps. This was enough to worsen mortgage rates or fees. Mortgage rates were fairly volatile most of the week.

This Week's Rate Forecast: Neutral

Three Things: These are the three things that have the greatest ability to impact pricing this week. 1) President Trump, 2) GDP and 3) Treasury Auctions.

1) President Trump. By far the most important factor this week as the bond market will react to Executive Orders and any other policy updates. Of interest is backing out of TPP (expected today) and the beginning of renegotiating NAFTA. He also made statements of putting together “massive” tax reductions for the middle class and corporations.

2) GDP. We get our first look at the 4th QTR GDP and the final revision to the 3rd QTR GDP on Friday and is the most important economic event of the week.

3) Treasury Auctions: These are shorter term notes this week but will be the first sales of the new administration. Today, 2-year note. Tuesday is 5 year note and Wednesday is the 7 year note which will be the most important of the three.

This Week's Potential Volatility: High

President Trump’s comments and executive orders are the most likely events to move mortgage rates and cause volatility in the mortgage rate markets.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.