Weekly Mortgage Rate Update (January 18th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

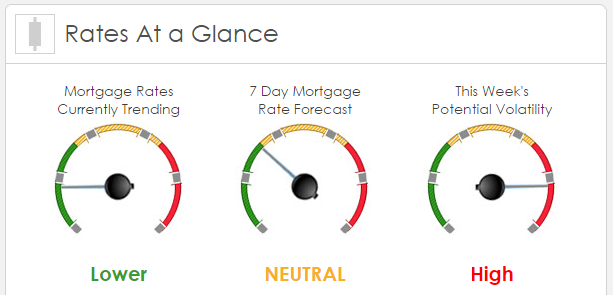

Rates Currently Trending: Lower

Sigma Research says that rates are trending slightly worse this morning. Last week the MBS market improved by +19bps. This was probably not enough to affect rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

Three Things: These are the three things to watch as they will be the driving forces in pricing this week: 1) Oil, 2) China, 3) ECB Meeting. Notice all three are events that are outside of the U.S. Domestically we have a very light week for economic data. However, we’ll want to keep an eye on existing home sales that is releasedFriday. Texas Tea, Black Gold: We start the week with Oil once again under pressure as Crude oil is down -0.48% as lower demand (China) and a glut of new supply is ready to hit the markets (Iran) is driving pricing lower.

China: Their GDP data hit 6.9% which magically matched market expectations of 6.9%. This is a drop from 2014’s reading of 7.3%. Both steel and electrical power production fell in 2015 for the first time in decades. While the headline reading was designed/crafted to calm the markets, it is clear that traders simply aren’t buying it.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week. No major economic news due out this week that is likely to move mortgage rates. Oil continue to be the main driver of mortgage rates and as long as there’s a lot of uncertainty in that market, we’ll see mortgage rates make big moves.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.