Weekly Mortgage Rate Update (January 11th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

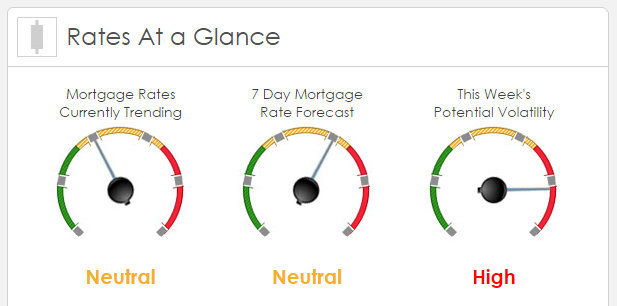

Rates Currently Trending: Neutral

Sigma Research says that rates are trending slightly worse this morning. Last week the MBS market improved by +65bps. This was probably enough to improve rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research Chinese stocks slumped 10% last week as Beijing allowed a steeper-than-expected fall in the Yuan’s value against the dollar, sparking concern that policy makers are more worried about the country’s economic health than they had previously let on . This helped push mortgage rates lower.

Treasury auctions and Fed speakers dominate US news this week untilFriday when markets will get Dec retail sales and Dec PPI. Of course China and global concerns trump all this week. Nothing has changed from last week; the China concerns remain the focus this week.

We can’t say it too often, interlay and intraday volatility will continue this week and likely for the next month. The idea that the Fed will hold onto its four FF increases this year is still there, not sure how long markets will follow that belief.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week. As noted above we have Fed officials speaking today and a few economic releases that the markets can react to, but right now all eyes are on China.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.