Weekly Mortgage Rate Update (February 6th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

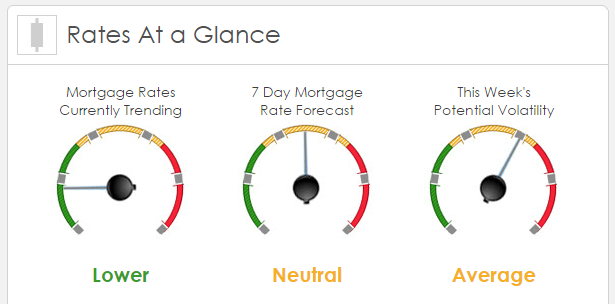

Rates Currently Trending: Lower

Mortgage rates are trending slightly lower this morning. Last week the MBS market improved by +10 bps. This was probably not enough to improve mortgage rates or fees. They market experienced high volatility last week.

This Week's Rate Forecast: Neutral

Three Things: Here are the three biggest events that have the highest potential to impact mortgage rates this week: 1) Trump, 2) Talking and 3) Across the Pond.

1) President Trump. On Friday, MBS sold off from their intra-highs after Trump signed an executive order that addressed part of Dodd-Frank. It was reported that part of that order pushed back the implementation of the fiduciary responsibility clause that was supposed to start in April, back 180 days for review. However, on MondayMBS rallied in early trading as it was discovered that the delay was in earlier versions of the memo and not in the final memo signed by Trump. This just illustrates the point that his administration’s actions have more of an impact on long bonds than anything else. The bond market is still waiting to see what kind (if any) financial stimulus will be proposed and we still don’t have any official proposal on tax reform. If we get any real movement on any of those two, it will have a significant impact on mortgage rates.

2) Fed: Last week, we got a fairly “hawkish” policy statement but no real action. The bond market currently has a very low probability priced in to the Fed’s March meeting for a rate hike but this week’s slew of Fed officials could change that.

- 02/06 Patrick Harker

- 02/09 James Bullard, Charles Evans

3) Across the Pond:

ECB: President Mario Draghi spoke this morning and confirmed that there will be no changes to their economic policy in the near future and attempted to talk up the market saying that currency values are in line with asset and equity fundamentals.

China: We get a very important Import and Exports as well as their Caixin Services PMI data.

Japan: We get their Trade Balance data as well as the Bank of Japan’s Summary of Opinions.

Treasury Auctions this week:

- 02/07 3-year note

- 02/08 10-year note

- 02/09 30-year bond

This Week's Potential Volatility: Average

The above three things are the likely events that can cause significant volatility in mortgage rates. However, we’re looking for a relatively calm week in mortgage rates. Of course things can change very quickly with unexpected news.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.