Weekly Mortgage Rate Update (February 29th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

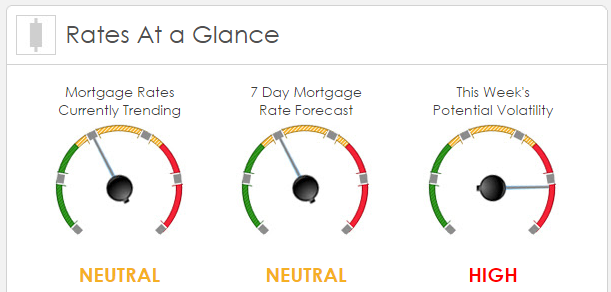

Rates Currently Trending: Neutral

Sigma Research says that rates are trending slightly worse this morning. Last week the MBS market worsened by -17 bps. This may’ve been enough to affect mortgage rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

The Big Three: 1) Jobs, 2) Services and 3) Manufacturing.

Jobs: We have a dozen different data points this week that either deal with jobs directly or labor costs. The tidal wave of jobs data really kicks off Wednesday with the ADP Private Payrolls report and culminates with our Big Jobs Friday.

Manufacturing: We start the week off with today’s Chicago PMI and it was much weaker than expected, coming in at 47.6 vs est of 53.0. Remember, any reading below 50 is contraction. But more importantly is Tuesday’s ISM Manufacturing report which is expected to come in below the very important 50.0 level again.

Non-Manufacturing: More importantly that all the manufacturing data above, we will get our national report card on the Services sector with Thursday’s release of the ISM report. Housing: Pending Home Sales in January were lighter than expected despite falling mortgage rates (-2.5% vs est of +0.5%). Since these are “pending” many will not close. Still, it yet another report that demonstrates a huge lack of available inventory and shores up the “seller’s market” theme.

This Week’s Potential Volatility: High

According to Sigma Research , as noted above, we have a dozen different job related data points this week. It’s likely to be a doozy. These numbers are likely to cause volatility in mortgage rates.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today, contact your mortgage professional to discuss it with them.