Weekly Mortgage Rate Update (February 27th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

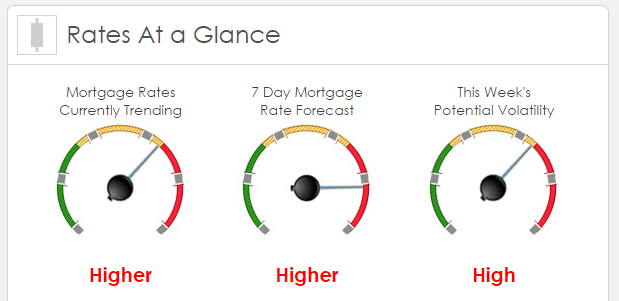

Rates Currently Trending: Higher

Mortgage rates are trending slightly higher this morning. Last week the MBS market improved by +53 bps. This was enough to improve mortgage rates or fees. Mortgage rates experienced moderate volatility.

This Week's Rate Forecast: Higher

Three Things: These three areas will receive the most attention from long bond traders and therefore have the greatest potential to impact mortgage rates: 1)Fed, 2) President Trump and 3) Domestic.

1) Fed: There is no question that the majority of voting members and even Janet Yellen herself have attempted to get the markets to move towards a “live” March Fed meeting. But so far, their lip-service has not worked. This is their last week to make an effort to move the needle for a rate expectation as we enter a “black out” period next week for the Fed.

We get their Beige Book on Wednesday which takes all 12 Federal Reserve Districts’ anecdotal reports and combines them specifically to be reviewed and used in their interest rate decision.

- 02/28 Esther George, John Williams and James Bullard

- 02/29 Robert Kaplan and the Beige Book

- 03/01 Loretta Mester

- 03/02 Charles Evans, Jeffrey Lacker and Janet Yellen

2) President Trump: He is speaking today in front of the State Governors and the bond market will react to any statements that he makes to them. But the real key is Tuesday nights address to Congress where he may (or may not) discuss specifics on taxes, spending and could even present a budget that will need to be voted on.

3) Domestic: After last week’s “yawner’ of lower level economic releases, we have a very robust schedule with some of the biggest releases of the quarter. We get the 4th QTR GDP but this has already been released once and will probably see a small upward revision, Durable Goods are too volatile for economists to draw any real correlation with economic growth. So, while those are big name reports, the most important ones are actually the Core PCE on Tuesday (will it move from 1.7% closer to the 2% target?), manufacturing data with Chicago PMI and ISM will be key as will Friday’s ISM Services reading.

This Week's Potential Volatility: High

Today we expect to see a bit of an uptick in mortgage rates from the move lower last week. Overall, volatility should be relatively high for the week because of the three things listed above.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.