Weekly Mortgage Rate Update (February 22nd, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

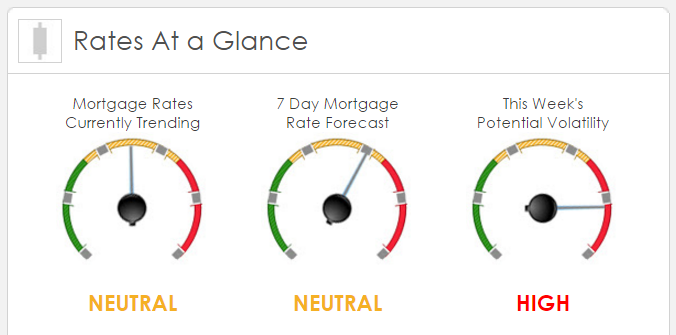

Rates Currently Trending: Neutral

Sigma Research says that rates are trending slightly worse this morning. Last week the MBS market improved by +18bps. This was probably not enough to affect rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

The big 3: The following three items will garner the most attention from long bond traders this week 1) Oil, 2) GDP and 3) Durable Goods.

Oil Leveled off last week and if that bottom holds this week, we could see some of that premium get lifted out of MBS. Remember, oil is really being treated as a proxy for Fed interest rate moves by bond traders. We will get the first revision to the previously released 4th QTR GDP. The expectations is that it will remain positive but that the original reading could be almost cut in half. While this is trailing data, the size of the revision upward or downward can have a big impact on mortgage rates this week. The very volatile and rocky Durable Goods data is expected to flip-flop and make some positive gains. This could make for a crazy Thursday.

This Week’s Potential Volatility: High

According to Sigma Research there are a number of key reports this week; sales of existing and new home sales, Jan personal income and spending, Q4 2nd look at GDP, Jan durable goods orders, and Treasury auctioning $88B of notes. This will cause increased volatility throughout the week.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.