Weekly Mortgage Rate Update (February 13th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

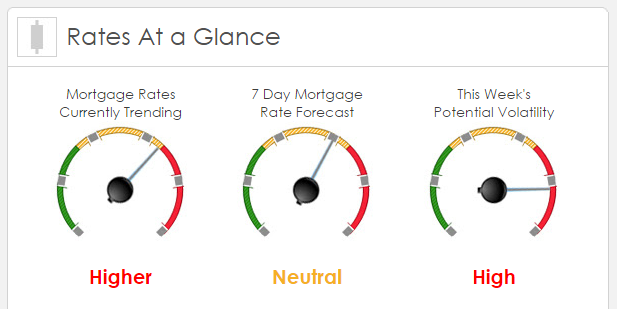

Rates Currently Trending: Higher

Mortgage rates are trending slightly higher this morning. Last week the MBS market improved by +22bps. This was not enough to meaningfully improve mortgage rates or fees. While the week ended only slightly better, we saw big mortgage rates swings throughout the week.

This Week's Rate Forecast: Neutral

Three Things: These are the three most important areas that have the greatest ability to influence mortgage rates this week: 1) President Trump, 2) The Fed and 3) Domestic

1) President Trump. The bond market moved off of their best levels last week after he simply mentioned an announcement over tax reform over the next couple of weeks. This demonstrates that point that with reduced regulation and generally favorable policies towards economic growth, the bond market will react strongly to any details from his administration. He starts the week off meeting with the Canadian Prime Minister to discuss NAFTA further.

2) The Fed: Normally, this would be Thing One instead of Thing 2 but that is simply how things are right now….the President has more influence on future growth/inflation/rate expectations than Fed policy does. With Tarullo’s retirement, Trump now has the ability to nominate 3 vacant seats on the Federal Reserve Board of Governors, followed by Yellen in Feb 2018 and Fischer in June 2018. In other words, he has the ability to change 5 seats in the Fed in the near term. That means the bond market is looking at the current Fed members and saying “sure….but you won’t even be here next year to follow through with your policies”.

Regardless, we get a lovely Valentine’s Date with Fed Reserve Chair Janet Yellen on Tuesday as she gives her semi-annual testimony in front of the Senate.

- 02/13 Janet Yellen, Jeffrey Lacker, Dennis Lockhart and Robert Kaplan

- 02/14 Janet Yellen, Eric Rosengren

- 02/17 Loretta Mester

3) Domestic Flavor: Unlike last week, we have a lot of domestic economic data to digest this week. We get key inflation measures with both PPI and more importantly CPI. The biggest report of the week is Wednesday’s Retail Sales data.

Dumping our Debt: A trend that started in the later part of 2016 is that key holders of our debt (U.S. Treasuries) have been lightening up (dumping) their positions. Why? Because the expect stronger global growth, and bonds/notes that are interest rate sensitive are not a good place to be if that is your expectation. China was the number one holder of U.S. Treasuries but sold off, making Japan the number one holder, but Japan sold off as well in December. They lowered their holdings to a level not seen since 2013. We get key TIC data this Wednesday and it could have an influence on mortgage rates.

This Week's Potential Volatility: High

As noted above, we have a number of events that could move mortgage rates. Look for volatility throughout the week but particularly Tuesday as the markets digest Janet Yellen’s comments.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.