Weekly Mortgage Rate Update (December 7th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

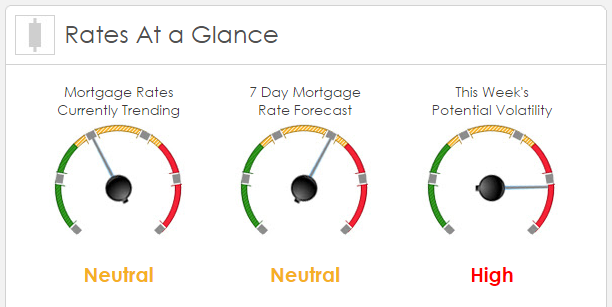

Rates Currently Trending: Neutral

Sigma Research says that rates are trending better this morning. Last week the MBS market worsened by -10 bps. This was probably not enough to affect rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research the markets were rattled last Thursday and Fridaywith the ECB not doing what markets had been led to believe and the employment report much better in terms of jobs that expectations. Take wider look however, with that kind of daily volatility it is important to put it in perspective. MBS were down only 10 BPS from Monday until Friday, which is not enough to affect rates or fees. With the Fed poised to increase rates in a week markets were tenuous, not sure what a rate increase would do to the economy or to the interest rate markets. Some believing a rate hike already had been discounted in present rate levels, others conjecturing a rate increase may actually stimulate growth, while still others were making huge bets that the dollar would strengthen to parity against the euro.

This Week’s Potential Volatility: High

According to Sigma Research volatility potential will remain high this week. Particularly Thursday and Friday when we get Weekly Jobless claims and Retail Sales.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.