Weekly Mortgage Rate Update (December 21st, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

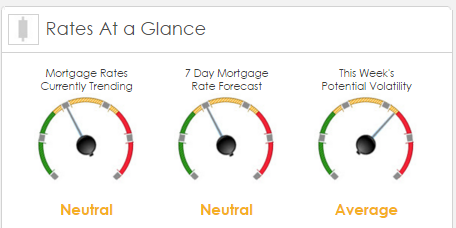

Rates Currently Trending: Neutral

Sigma Research says that rates are trending slightly better this morning. Last week the MBS worsened by -29bps. This was probably not enough to affect rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research it is Christmas week and it is the beginning of the two week holiday. Many won’t work this week, others will be part time. This week however has a number of key economic reports. This morning the stock market started better, the bond and mortgage markets also a little better early this morning. Today there are no economic reports and thankfully no Fed officials to muddy waters. Hopefully markets will do what they do on holiday weeks; stay quiet. Equity market volatility last week should diminish this week. A short week with many done for the year can lead to volatility if unexpected events or news occurs. Can’t guarantee stability, and it is usually difficult to separate low volume from significant changes—-if any.

This Week’s Potential Volatility: Average

According to Sigma Research the risk of volatility will continue to diminish toward the beginning of the week. Given the holidays over the next two weeks we should see the market continue to calm down.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.