Weekly Mortgage Rate Update (December 14th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

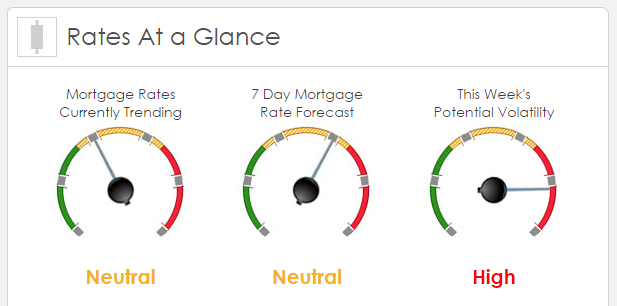

Rates Currently Trending: Neutral

Sigma Research says that rates are trending slightly worse this morning. Last week the MBS market improved by +17bps. This was probably not enough to affect rates or fees. The market was extremely volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research Friday’s huge drop in stocks (DJIA -309) drove interest rates lower and prices higher, one of the best moves in weeks.

In the face of the FOMC on Wednesday traders and money managers attempting to position before the policy statement. It isn’t so much the Fed is expected to increase the FF rate by 0.25%, but how the policy statement and the press conference from Yellen frame the outlook for additional increases. This week is completely about the Fed; beside the policy statement and Yellen’s press conference on Wednesday, the Fed will release its quarterly data on growth and inflation. Over the last two years those quarterly reports have generally missed most projections.

No news that this is a key week. The FOMC set to increase rates, the bank needs to do it for numerous reasons, the number one reason, so the Fed has room to lower the rate again if (when) the economy stumbles again. Markets today are not buying the Fed’s belief of continued growth, markets expect China’s economy to continue to weaken, the ECB is worried enough to continue buying €60B a month in stimulus moves. The Fed is saying Dec 2016 FF rate will be 1.375%, a rather astounding forecast; markets in the mean time looking for just 0.76%.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week. While the MBS market only improved by +17 bps (no affect on mortgage rates) the week was full of big mortgage rate swings. This week we expect continue volatility as noted above. This may be the most important day of the week and help point the direction of mortgage rates for next week.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.