Weekly Mortgage Rate Update (August 3rd, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

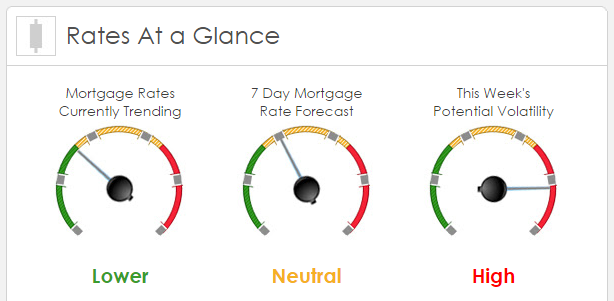

Rates Currently Trending: Lower

Sigma Research said that rates are improving this morning. Last week the MBS market improved by +47bps. This was probably enough to affect rates or fees. While the MBS market had a nice improvement (better rates), the volatility was low to moderate.

This Week’s Rate Forecast: Neutral

According to Sigma Research there was nice price improvements in the MBS market (lower rates) on Friday led by Q2 employment cost index, the lowest in 33 yrs. No inflation helps support fixed incomes like treasuries and MBSs. Markets took it as an indication that the labor market may not be as healthy as the unemployment rate suggests. That in turn could lead the Federal Reserve to push back its first interest-rate increase in nearly a decade.

The Greek stock market opened today and lost about one fifth of its value; the market has been closed for five weeks until today. The Greek Purchasing Managers Index fell to 30.2 for the month of July, the lowest level recorded in the series’ 16-year history. Asian markets declined, another weak data point from China on factory usage. Unlike last week, we have some important employment data being released toward the end week that will cause market volatility. We’re neutral this week because even though the trend is for lower rates over the last couple of weeks, the employment data this week will set the trend. Until that number is released, it’s anyone’s guess.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is moderate today and high for the week. As stated above, we have employment data being released this week that will cause so market volatility.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.