Weekly Mortgage Rate Update (August 31st, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

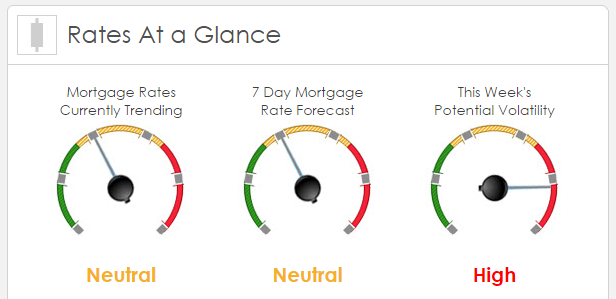

Rates Currently Trending: Neutral

Sigma Research said that said rates are trending essentially unchanged this morning. Last week the MBS market worsened by -26 bps. This was probably enough to affect rates or fees. The market was very volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research at the Jackson Hole symposium ended Saturday with the obligatory remarks from Fed officials that attended. Vice Chair Stanley Fischer commenting that the Fed is still uncertain about when to increase rates, pointing to more dependent data coming before the meeting on Sept 16th and 17th. Fischer saying the Fed should move before inflation begins to pick up; the lack of inflation has twisted the Fed in a knot, expecting inflation to climb for the last 18 months but it hasn’t happened and in our view won’t happen this year or next. There are still those at the Fed still holding out for a move at the Sept meeting, and commenting that there is still data to be looked at are running out of time. Markets do have key data points this week but next week there isn’t much on the calendar. Two weeks from this Thursday is the time line.

In the meantime there is key data, including the August employment statistics coming on Friday.This week both August ISM indexes, August auto and truck sales, Q2 productivity and unit labor cost revisions, the Fed Beige Book.

China will release reports on its economy this week but there is increasing concern in markets that China’s data is not to be trusted; too optimistic, and that is a scary thought given the current economic slide. China continues to help keep mortgage rates low. With mortgage rates once again trading in a fairly tight range with large intraday changes we will need so new information to push up out of the trading channel.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week. We sound like a broken record from week to week, but until the market receives a clear reading from the Fed we’ll continue to see high volatility from day to day.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.