Weekly Mortgage Rate Update (August 28th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

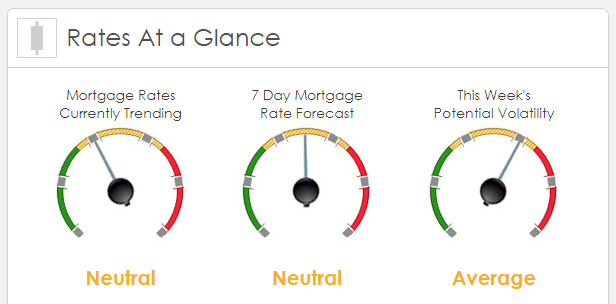

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +7 ps. This wasn’t enough to improve mortgage rates or fees. Mortgage rate volatility remained low.

This Week's Rate Forecast: Neutral

Three Things: These three things have the greatest ability to impact mortgage rates this week. 1) Jobs. 2) Geopolitical and 3) Across the Pond.

1) Jobs: We have a very robust domestic economic calendar which will see revisions to the 2nd QTR GDP and some important manufacturing data with Chicago PMI and ISM. But the bond market will focus on Big Jobs Friday as it is the last jobs report before September’s Fed Meeting. While the rolling three-month trend line for Non-Farm Payrolls is not likely to change, and neither is the 4.3% Unemployment Rate, the bond market will pay very close attention to Average Hourly Wages. Specifically, the YOY reading which was at 2.5% and is anticipated to rise to 2.6% or 2.7%. The higher that number is, the worse it is for rates.

2) Geopolitical: Harvey is devastating much of Texas, and Texas is one of the main driving engines in our national economic output. In the short term, the massive disruption will be a hit to GDP which is good for rates, but it also will cause a spike in refined gas prices which is negative for rates. Additionally, in the near term, it will cause a significant spike in construction and rebuilding which will be a larger gain to GDP in the 4th QTR. President Trump is also in the spot light as he tries to push forward with Tax Reform.

3) Across the Pond: There are a lot of important data coming out of the worlds’ largest economies this week. Because expectations of foreign growth/inflation is a major factor in bond prices, we’ll be paying close attention:

China (number 2 economy): PMI manufacturing and services.

Japan (number 3 economy): Unemployment Rate, Retail Sales, Industrial Production, Nikkei Manufacturing PMI and Consumer Confidence.

Treasury Auctions this Week:

- 08/27 2 Year and 5 Year note auctions

- 08/28 7 Year note

This Week's Potential Volatility: Average

Mortgage rates are likely to continue to trade in a very tight range. We could see some mortgage rate volatility with the Average Hourly Wages report on Friday.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.