Weekly Mortgage Rate Update (August 24th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

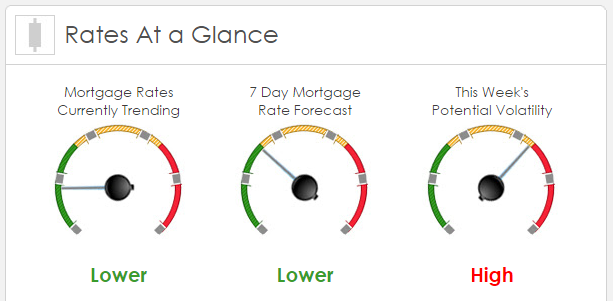

Rates Currently Trending: Lower

Sigma Research said that rates are trending positive this morning. Last week the MBS market improved by +73bps. This was probably enough to improve rates or fees. The market was very volatile last week and expect to experience more of the same this week.

This Week’s Rate Forecast: Lower

According to Sigma Research the global equity markets continued their sell-offs today. China leading the way down just as it led global equity markets higher from 2009. China trying to stop the decline in its markets reduced bank reserves to increase lending; a fool’s attempt to stop their markets and economy from declining more. The infection began to spread globally two weeks ago when China surprised the world by de-valuing its yuan. Treasuries gaining as investors seek the relative safety of government bonds, today feeding into MBSs after Friday’s rather subdued improvement in MBS prices. This is the major correction we have been expecting for over a month now, having no idea when it would happen. US and global markets were very over-valued, trading on central bank market manipulations for the last five years. Now it is panic in equities as the reality has set in rapidly. Global economic growth, even with the central banks running printing presses at warp speed, cannot override reality that growth hasn’t been as strong as the headlines had been indicated.

This is the natural and unavoidable aftereffect of a global liquidity bubble brought on by central banks the world’s main central banks. Over the last few months the data reported didn’t faze central bankers, especially our Fed; we have noted before the central banks were treading on ground they had no idea how it would play out; there has not been a condition like this since the depression. With all of those platitudes from almost every US Fed officials, it was just hoping and guessing but eventually reality always come to the top of the boiling pot. There are numerous thoughts floating around over the last week about why the collapse of equity markets. Let’s not make too much out of it trying to figure it out looking at all of the “rationale” being spewed now; no matter how deep you go in divining the reality, all we need to realize is that the economies of the world are not nearly as strong as those headlines that investors put huge faith in. This will help keep mortgage rates low, but we’re likely to see some bumpy times in the near term with rates sinking and spiking with regularity.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week. The markets are reeling this morning, but we expect it to calm down during the course of the day. We have some important economic news coming out this week with the GDP and Durable Goods Orders. They will certainly influence the market and add additional volatility this week.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.