Weekly Mortgage Rate Update (August 17th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

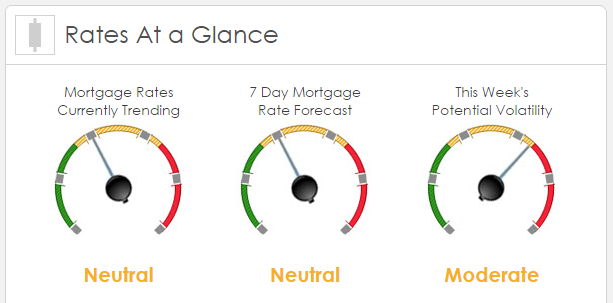

Rates Currently Trending: Neutral

Sigma Research said that said rates are trending slightly better this morning. Last week the MBS market worsened by -44 bps. This was probably enough to worsen rates or fees. There was relatively high volatility last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research at 10:00 AM EST the Aug NAHB housing market index, expected at 61 from 60 in July was right on, buyer traffic increased from 43 to 45; 50 is the line between contraction and expansion. This is overall positive for housing and in line with expectations.

Greece’s debt relief is increasing likely according to Angela Merkel in an interview yesterday. It will happen and markets have pushed its importance off the front page replaced by China’s economic downturn and its currency devaluation. Merkel said she fully expects the IMF will be an integral part of the debt relief and Greece getting the needed monies to pay the ECB; “I have no doubt that this will happen.” The main piece of news that could really move mortgage rates is the FOMC minutes released on Wednesday.

Economists continue to expect the Fed to increase rates in September, so we’ll need to hear something that is a departure from that stance.

This Week’s Potential Volatility: Moderate

According to Sigma Research the risk for volatility is moderate to high today and this week. We’re trading in a fairly tight range and something unforeseen will need to happen to push us out of this relatively tight trading range.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.