Weekly Mortgage Rate Update (August 10th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

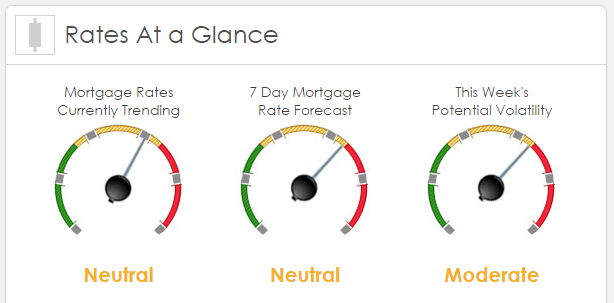

Rates Currently Trending: Neutral

Sigma Research said that rates are trending slightly worse this morning. Last week the MBS market worsened by -2bps. This was not enough to affect rates or fees. There was a bit of volatility in the market last week, certainly more than the -2 bps would suggest.

This Week’s Rate Forecast: Neutral

According to Sigma Research said at about noon today Atlanta Fed President is scheduled to speak, last week his remarks that the Fed is ready to move rattled markets for a moment or two. Friday’s July employment report was right in line with most all forecasts, nice job gains. Unemployment headline 5.3% as expected but the U-6 unemployment rate at 10.4%. Although there are another complete series of data points before the next FOMC meeting (Sept 16th and 17th) the Fed is making it clear that absent a complete turn in the economic outlook it wants to move in Sept.

We have held that a rate move this year was not likely, based on incoming data and increasing comments from various Fed officials no matter the wider deterioration of global growth and no inflation the Fed seems determined to make the move, now likely in Sept. It is however subject to events and data between now and the next meeting. Interest rates increasing slightly higher this morning after a nice rally over the last week. Belief that China’s leaders will increase spending and continue to prop up the equity market by buying shares has bolstered equity markets globally taking the demand away from safety moves to treasuries that fed MBS prices higher.

This Week’s Potential Volatility: Moderate

According to Sigma Research the risk for volatility is moderate to high today and this week. As stated above, the Atlanta Fed President is scheduled to speak and this can always move the market at least temporarily. We’ve been trading in a fairly tight channel with moderate to high volatility for over a week. When do break this channel, to the up or down side, we’ll go from moderate volatility to high volatility.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.