Weekly Mortgage Rate Update (October 12th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

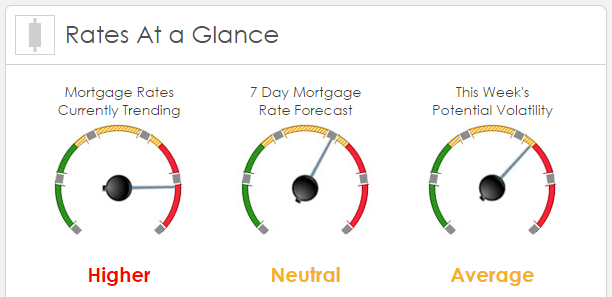

Rates Currently Trending: Higher

Sigma Research said that mortgage rates are trending slightly worse this morning. Last week the MBS market worsened by -37 bps. This was probably enough to affect rates or fees. The market was relatively calm last week even though we ended the week with a bit of a decline in the MBS market.

This Week’s Rate Forecast: Neutral

According to Sigma Research yesterday Fed governor Lael Brainard stepped up; another Fed official that hasn’t been heard for a while. She doesn’t want the Fed to increase the FF rate now, the risks “argue against prematurely taking away the support that has been so critical to [the U.S. economy’s] success.” At recent count, four Fed officials don’t want to move this year while 13 others do want to move. Looks like the Fed is still in that very dark room, bumping into each other trying to find the light switch. The labor participation rate is the lowest since 1977 (62.4%) but Yellen and others continue to talk about the 5.1% unemployment rate as a reason to consider increasing the FF rate soon. More negative news out of China; imports extended the longest losing streak in six years. Imports declined 17.7% in yuan terms in September from a year earlier, increasing from a 14.3% decrease in August and posting an 11th straight decline. Exports fell 1.1% in September in yuan terms, compared with a 6.1% drop in August. The trade surplus was 376.2 billion yuan ($59.4 billion). The world’s second largest economy continues to sow; economists are now questioning China’s growth as reported by Chinese authorities, less than what officials are saying.

This Week’s Potential Volatility: Average

According to Sigma Research the risk for volatility is average today and this week. However, we’ll be keeping our eye on Retail Sales on Wednesday which could cause some volatility in the market. The market is trading in a very tight range, but we continue to see a slide in MBS pricing (higher rates). We remain very cautious.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.