Weekly Mortgage Rate Update (September 28th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

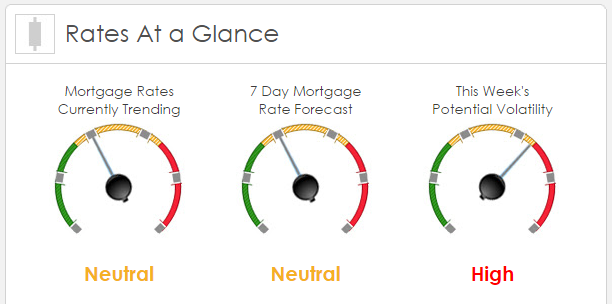

Rates Currently Trending: Neutral

Sigma Research that rates are trending worse this morning. Last week the MBS market worsened by -9 bps. This was probably not enough to affect rates or fees. The market was volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research NAR at 10:00 AM EST reported pending home sales, expectations were for an increase of 0.5%, as reported sales declined 1.4% and yr./yr. +6.1% but the yr./yr. sales have been dropping for the last couple of months. The reason is the same lack of inventory and increasing prices. This is a big week with a number of key data points culminating with Friday’s Sept employment data. Janet Yelled will speak again on Wednesday in St. Louis. Already today NY Fed President Bill Dudley out saying the Fed will likely move this year. Charles Evens (Chicago) will speak this afternoon; all of the Fed officials gathering around the flag talking about a rate increase before the end of the year. With employment and constant speeches from Fed officials this week we are not expecting much change between now and Friday. The bond and mortgage markets are back to tracking how stock indexes trade; lower stock indexes will support the bond market, stronger indexes are pressuring the bond market these day with little movements in rates.

This Week’s Potential Volatility: High

According to Sigma Research the risk for volatility is high today and this week. While as noted above, we’re not expecting a big change this week in mortgage rates we may see intraday volatility which has been the case for several weeks now. Friday employment data may cause high volatility and a more significant movement in mortgage rates.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.