Weekly Mortgage Rate Update (September 26th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

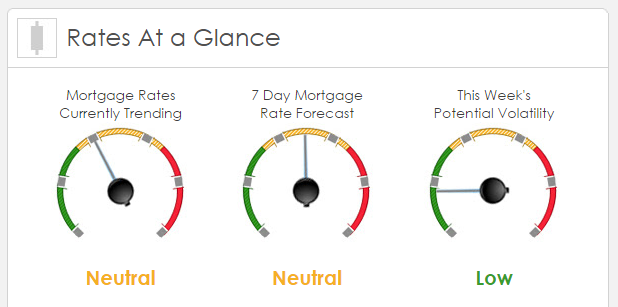

Rates Currently Trending: Neutral

Mortgage rates are trending slightly lower this morning. Last week the MBS market improved by +40 bps. This was enough to improve mortgage rates or fees. The mortgage rate market was highly volatile last week.

This Week's Rate Forecast: Neutral

Three Things: The following Three Things have the biggest potential to directly influence long bond yields (and therefore mortgage rates). 1) OPEC Meeting, 2) Presidential Debate and 3) PCE Thing

1) OPEC meeting. This Tuesday’s meeting will be key. While no one expects any real cuts, there has been swirling discussions on putting some “freezes” on current levels. This is important for a couple of reasons. First and foremost, this is a group that is politically fractured and has not been able to move markets as they simply have not been a unified front. But if the new minister can piece an agreement together this could mean that they will once again have some influence. Secondly, anything that would cause WTI Oil to move back above $50 is inflationary and therefore negative for all bonds.

2) The Great Debate. The most anticipated Presidential debate in decades could get Super Bowl level ratings. But how can this impact mortgage rates? Well from purely an analytical point of view, generally speaking – a Trump Presidency will mean higher rates. But is that a bad thing? Moving from 0.375% to 0.500% Fed Fund rate to a 3.50% Fed Fund Rate is not what I am talking about. Interest rates are reflection of the state of the economy. A high interest rate signifies an economy growing too fast. A super low interest rate signifies an economy that is contracting or barely growing. We know from the Central Bank that they are forced to have certain policies in place because our elected officials have had grid locked. We haven’t had a budget in almost 10 years. So, here’s how long bond traders look at this: If Trump wins, his lower taxes and a balanced budget would be better for economic growth than Hillary’s plan and no budget (ie more of the same gridlock). From a regulatory point of view, many would prefer Hillary because of the grid lock.

3) PCE. While we o have GDP this week, its a tired old 3rd revision to the 2nd QTR. But PCE (specifically Core YOY) will be closely watched to see if we make any headway to that magical-mythical 2% level.

This Week's Potential Volatility: Low

We expect mortgage rates to be relatively calm today. Tomorrow, we may see some volatility depending on how the debate goes and on OPEC. And IF Trump is strong and OPEC gets a freeze, then MBS will be under pressure for reasons stated above.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.