Weekly Mortgage Rate Update (September 19th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

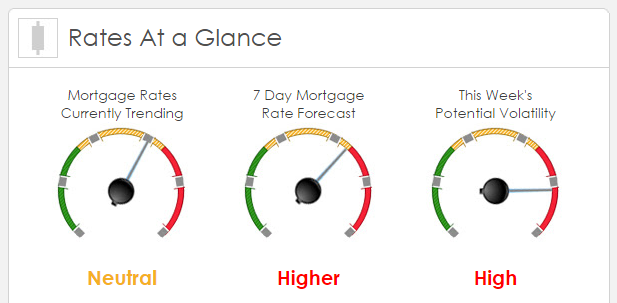

Rates Currently Trending: Neutral

Mortgage rates are trending slightly higher this morning. Last week the MBS market worsened by just -1bps. This was not enough to worsen mortgage rates or fees. While the week ended unchanged, mortgage rates experienced very high volatility.

This Week's Rate Forecast: Higher

Three Things: These are the three events that have the greatest potential to impact MBS trades. 1) The FOMC, 2) The BofJ and 3) The ECB/Draghi. Yes, all of my Three Things are basically a Central Bank Palooza as there are no domestic economic reports that can impact pricing this week.

1) The FOMC (Federal Open Market Committee) will conclude two days of meetings on Wednesday. Here is what we’ll get: 2:00 EST Policy Statement and Interest Rate Decision. 2:00 ESTEconomic Projections and Dot Plot Chart. 2:30 EST Live press conference with Fed Chair Janet Yellen. The market is basically pricing in zero chance of a rate hike, but the market could be wrong. Even if we don’t get a rate hike, will the language turn more “hawkish” to prep everyone for a December rate hike? The “dot plot” chart with all members (voting and non voting) best guestimates of future interest rate levels by month will also get a lot of attention. Of course Janet Yellen is the dog that wags the tail and her responses to live questions from financial reports can really move the markets.

2) The BofJ (Bank of Japan) they also have their Central Bank meeting along with the release of their economic projections and a live press conference by their Chair on Wednesday. It is widely expected that they will cut their rate even more negative but the unknown is any other action that they may take.

3) ECB (European Central Bank) They also have meeting on Wednesday but its a non-monetary policy meeting (meaning they wont set an interest rate). But the key will be on Thursday when ECB President Mario Draghi speaks and we will get their reaction to the BofJ and our FOMC. Will their action (or inaction) cause the ECB to loosen up and extend their bond buying program? While their are no major domestic economic releases this week, we do have a lot of real estate a news that will give us a good read on the state of our housing market with the releases of: Home Builder Sentiment, New Housing Starts, Building Permits, Weekly Mortgage Applications and Existing Home Sales.

This Week's Potential Volatility: High

This week COULD set the path for mortgage rates until the end of the year. Mortgage rates could stay relatively flat until Wednesday and then we could see mortgage rate volatility. We’ll be watching mortgage rates very carefully.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.