Weekly Mortgage Rate Update (September 12th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

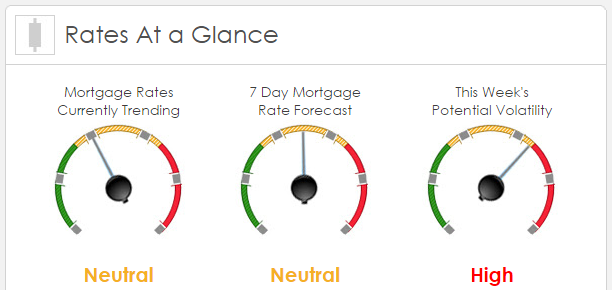

Rates Currently Trending: Neutral

Mortgage rates are trending unchanged this morning. Last week the MBS market worsened by just -1 bps. This was not enough to worsen mortgage rates or fees. The MBS market was fairly calm last week.

This Week's Rate Forecast: Neutral

Three Things: These are the three areas that have the greatest potential to influence mortgage rates: 1) Jobs data, 2) The Fed and 3) Manufacturing data.

Jobs: Friday’s Non-Farm Payrolls report will get the most attention. The market is expecting a reading around 180K, but if it tops 200K, then you will a migration into the September rate hike camp. But don’t forget about Average Hourly Wages which may actually carry more weight with the Fed as the YOY wage growth was a blistering 2.6% if we stay at that level or increase it, then it will be very negative for mortgage rates. But this data wont hit until Big Jobs Friday. We actually have a ton of jobs/wages data this week before Friday. We started today off with Personal Income witch rose a nice 0.4% in July, plus the June reading was revised upward.On Wednesday we get the ADP Private Payrolls report and then on Thursday we get the Challenger Job Cuts, Initial Weekly Jobless Claims and Unit Labor Costs. We also get ISM Manufacturing which has an internal labor component.

Fed: Last week, we heard from the three most important voting members – Yellen, Fischer and Dudley and all three tried to make it clear to the markets that progress has been made towards the Fed’s goals and that September is very much a “live” meeting. We will be paying very close attention to see if the overall “hawkish” tone from last week is continued other Fed speakers this week.

Manufacturing Data: Is the economy growing? At what pace? Our manufacturing data will give us the answers. We start off with Chicago PMI which is expected to show very strong expansion with a reading over 54. Then we get the national data with the ISM report which is also expected to be expansionary with a reading over 52. We round out the week with Factory Orders which is forecasted to also show some decent gains.

This Week's Potential Volatility: High

Like last week, the highest potential for enough volatility in mortgage rates to move us out of this extremely tight range will happen on Friday. The Fed is looking for strong employment numbers to give them the ammo needed to increase rates. If this happens, we could see a pop in mortgage rates.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.