Weekly Mortgage Rate Update (October 3rd, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

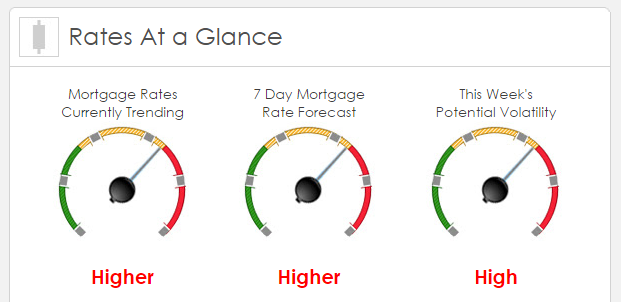

Rates Currently Trending: Higher

Mortgage rates are trending slightly higher this morning. Last week the MBS market improved by +9bps. This was not enough to improve mortgage rates or fees. It was a volatile week. MBS had a -42 BPS spread between our best pricing of the week (lowest rates) and our worst pricing of the week (higher rates).

This Week's Rate Forecast: Higher

Three Things: These three things have the greatest ability to influence mortgage rates this week: 1) Jobs 2) Manufacturing/Services and 3) Fed.

1) Jobs: We get a glut of jobs related data this week culminating in Big Jobs Friday. We will be paying very close attention to Average Hourly Wages (currently at +2.4% on a YOY basis) and the Non-Farm Payroll (NFP) data. The reading for September is probably not as much of a factor as the revisions to the prior months. August was reported at only 151K but we have seen significant revisions to Augusts in the past due to the seasonal adjustments.

2) Manufacturing: After last week’s better than expected Chicago PMI, will we have a strong round of data this week? So far, yes. The ISM Manufacturing report was a very solid 51.5 vs est of 50.3 and proved that August’s 49.4 was a fluke and not a trend. The Markit PMI report showed a slight improvement from August (51.5 vs 51.4). We also get Factory Orders this week. But the focus of bond traders/mortgage rates will be on Wednesday’s release of the ISM Services sector witch accounts for 75% to 80% of our economic output.

3) Fed:We get a steady stream and the markets will be taking their comments and the Jobs data on Friday to hedge ahead of the Nov and Dec FOMC meetings. 10/04 Lacker, Evans 10/05 Kashkari, Lacker 10/07 Fischer, Mester, George and Brainard.

This Week's Potential Volatility: High

We could see some volatility during the week, but we’re expecting mortgage rates to be fairly calm headed into Friday’s job report, with the exception of Wednesday’s ISM Non Manufacturing report.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.