Weekly Mortgage Rate Update (October 26th, 2015) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

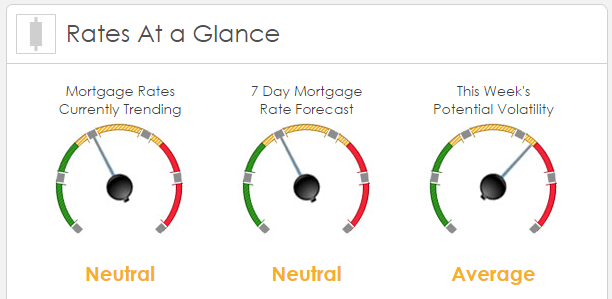

Rates Currently Trending: Neutral

Sigma Research says that rates are trending worse this morning. Last week the MBS market improved by-2 bps. This was not enough to affect rates or fees. The market was moderately volatile last week.

This Week’s Rate Forecast: Neutral

According to Sigma Research this week the FOMC meeting beginning tomorrow and the policy statement on Wednesday; there is no Yellen press conference and there will be no rate increase at the meeting, and likely none until at least mid-2016. The Fed cannot increase rates; corporate earnings and profits slowing, China lowering rates and the ECB talking about more QE in Dec. There are multitudes of reasons why the Fed can’t or shouldn’t increase rates now, one is the plight of the US dollar. A rate increase will send the dollar screaming higher and further drive multi-nationals into increasing losses. Not the prime reason but that is enough in itself to keep the central bank in check. Best thing for the Fed to do now is to take a long vacation, stop the constant speeches from regional Fed officials; no one cares.

Front page of the WSJ this morning; “Quarterly profits and revenue at big American companies are poised to decline for the first time since the recession, as some industrial firms warn of a pullback in spending.”….” Profit and revenue are falling in tandem for the first time in six years, with a third of S&P 500 companies reporting so far. Analysts expect the index’s companies to book a 2.8% decline in per-share earnings from last year’s third quarter, according to Thomson Reuters.”….” Sales are on pace to fall 4%—the third straight quarterly decline. The last time sales and profits fell in the same quarter was in the third period of 2009.” This is positive for mortgage rates.

This Week’s Potential Volatility: Average

According to Sigma Research the risk for volatility is average today and this week. While there’s a good deal amount of economic news this week, thus far we’ve traded in a very tight range over the last couple of weeks and don’t expect that to change without some unexpected news.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.