Weekly Mortgage Rate Update (October 17th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

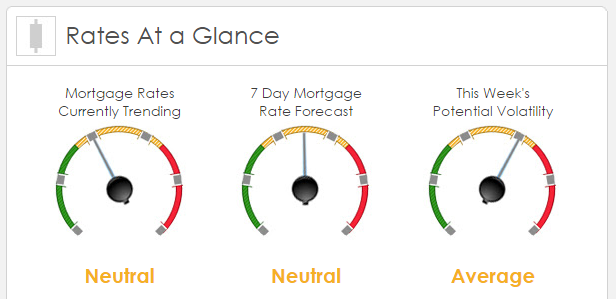

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market worsened by -57bps. This was enough to worsen mortgage rates or fees. Mortgage rates were relatively volatile last week.

This Week's Rate Forecast: Neutral

Here are the three things that have the ability to have the greatest impact on your mortgage rates this week: 1)Fed, 2) International , 2) Domestic.

1) Fed: We’ll get their Beige Book on Wednesday which is prepared by the 12 districts to be used specifically in the November Fed meeting to make decision on policy and rates. We also hear from the following Feds this week: 10/17 Vice Chair Fischer 10/19 John Williams, Robert Kaplan 10/20 William Dudley 10/21 Daniel Tarullo

2) International : 10/17 German Buba President Weidman, ECB President Draghi 10/19 Bank of Canada Policy Statement and Interest Rate Decision, NBS (Nation Bureau of Made up statistics) for China will hold their press conference. Great Brittan 10Y auction, German 30Y auction. 10/20 European Central Bank Police Statement and Interest Rate Decision.

3) Domestic: We actually have very few reports that have the gravitas to impact pricing. The biggest one of the week will be the CPI report as its one of the few measures that has been showing inflation above 2.00% ( Core YOY 2.3%). We do have a ton of housing data this week with the releases of the Home Builders’ Index, Mortgage Applications, New Housing Starts and Existing Home Sales.

This Week's Potential Volatility: Average

We have a lite data week this week. As a result, we don’t expect a lot mortgage rate volatility. Mortgage rates have been moving higher this month. While we don’t expect mortgage rates to jump too much higher today and this week, the trend is not in our favor.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.