Weekly Mortgage Rate Update (November 28th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

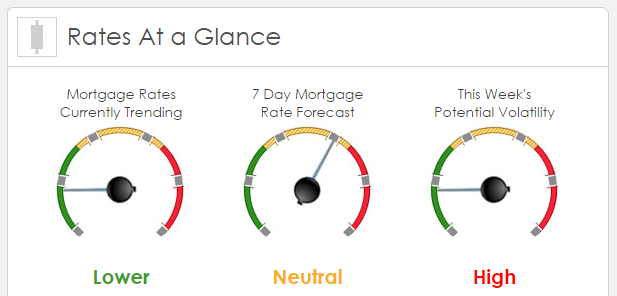

Rates Currently Trending: Lower

Mortgage rates are trending lower this morning. Last week the MBS market worsened by -13bps. This was enough to slightly worsen mortgage rates or fees. Mortgage rate volatility remained high.

This Week's Rate Forecast: Neutral

Three Things: These three things have the greatest potential to impact mortgage rates this week. 1) Jobs, 2) Domestic Data and 3) OPEC.

1) Jobs: We have a glut of wage and or jobs related data this week with ADP Private Payrolls, Personal Income, Challenger Job Cuts, Weekly Jobless Claims and Big Jobs Friday which will include the Unemployment Rate, Non-Farm Payrolls and Average Hourly Earnings. The most important data point is the Average Hourly Wages which was 2.8% on YOY basis last time around. Anything above that level would be negative for mortgage rates. Basically, the bond market has a December rate hike ALMOST priced in. It would take a dismal wave of jobs data to change that bias.

2) Domestic Data: If we strip out the very important jobs data, we still have a ton of big name economic releases that have the gravitas to move the needle. First up is the first revision to the 3rd QTR GDP data and given the huge beat in last week’s Durable Goods Data, we may see that break above 1.5%. But we also have Personal Spending and a very important YOY Core Personal PCE which is that magical data point that the Fed uses to measure inflation. Last time around it was 1.7%…will it creep closer to their target rate of 2.0%? We also have very important manufacturing releases with Chicago PMI and ISM Manufacturing.

3) Oil: Wednesday’s OPEC summit in Vienna may or may not yield any agreement. The market is expecting at least a “freeze” but that will largely depend on Iran’s decision. Their comments have been moving oil prices as they change positions. Even if a deal (in principal) is reached, no one expects Iran to honor or accurately disclose production levels….still it would be a long overdue symbolic gesture that OPEC still has relevance.

Fed: We get a barrage of Fed speak this week before entering next week’s “black out” period prior to the Fed meeting the following week:

- 11/29 Stanley Fischer, William Dudley

- 11/30 Robert Kaplan, Jerome Powell, Loretta Mester and the release of the Fed’s Beige Book.

- 12/02 Daniel Tarullo.

Across the Pond: The bond market is continuing to watch political events in Germany, France and most notably Italy where as many as 8 Italian banks may face problems moving forward.

This Week's Potential Volatility: High

Mortgage rates should hold the slight improvement today with continued volatility today and the rest of the week. The OPEC deal, and how it unfolds, will be a major catalyst for the direction and volatility of mortgage rates. The markets will be keeping a close eye on the domestic data as well. Continued strength in the economic numbers will put further pressure on mortgage rates.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.