Weekly Mortgage Rate Update (November 21st, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

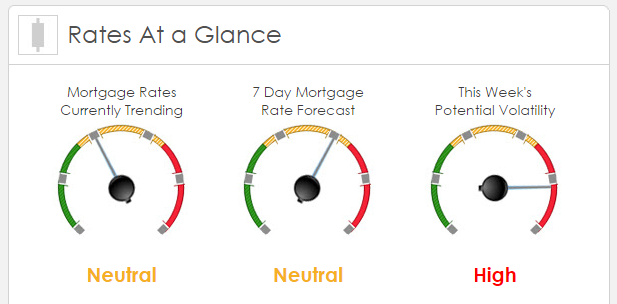

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market worsened by -113bps. This was enough to worsen mortgage rates or fees. The entire week was very volatile.

This Week's Rate Forecast: Neutral

Three Things: These Three items have the greatest potential to mortgage rates this week. 1) The Great Unwinding, 2) Domestic Data and 3) The Fed.

1) The Great Unwinding: As I have been discussing over the past two weeks, MBS holders want out. The only major entity that is willing to hold on to MBS longer term is the Fed. The remaining field is looking for their best timing and then will unload. This was demonstrated on Friday as MBS sold off in the absence of any market-moving news. It was solely due to more supply being liquidated. The pace and timing of other holders selling their positions will have a large impact on mortgage rates.

2) Domestic Data: We will get a lot of housing data this week which will give us a good read on the health of the housing market. These include Existing Home Sales, Mortgage Applications, New Home Sales and FHFA Home Price Index. But it will be Durable Goods that will have the most impact on mortgage rates. This has been volatile as of late with large swings in the reading.

3) Fed: We get to look “behind the scenes” of the last FOMC Meeting with the release of their Minutes on Wednesday. Also, Vice Chair Stanley Fischer said this morning that “Certain fiscal policies, particularly those that increase productivity, can increase the potential of the economy and help confront some of our longer-term economic challenges,” and “Some combination of improved public infrastructure, better education, more encouragement for private investment, and more effective regulation all likely have a role to play in promoting faster growth of productivity and living standards.”

Treasury Auctions This Week:

- 11/21 2 year note

- 11/22 5 year note

- 11/23 7 year note

Oil: On the Radar is next week’s OPEC meeting. WTI Oil is up on speculation that some sort of freeze will be announced. We will see some volatility as these rumors and announcements ebb and flow.

Turkey day! Wednesday is a full session on paper but traders will shut it down after the 2:00 PM Eastern release of the FOMC Minutes. The bond market is CLOSED on Thursday but will reopen on Friday only to CLOSE early at 2:00 Eastern on Friday. Bottom line is that we will see a skeleton crew of traders beginning Wed afternoon and some thinner volumes which can always skew the appearance of large movements up or down.

This Week's Potential Volatility: High

This is a short week for mortgage rates. As noted above, with the thinner trading volumes you can see exaggerated movement in mortgage rates. Given mortgage rates increased volatility over the last two weeks – we expect the trend to continue.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.