Weekly Mortgage Rate Update (March 20th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

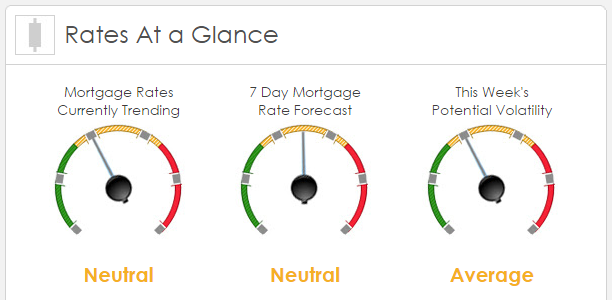

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +50bps. This was enough to improve mortgage rates or fees. Overall mortgage rates were volatile last week.

This Week's Rate Forecast: Neutral

Three Things: The following are the three items that have the greatest ability to influence mortgage rates this week: 1) Fed, 2) Across the Pond and 3) Domestic.

1) Fed: After last week’s “dovish” rate hike, the market is looking for more clarity and this week has a glut of Fed Speak which includes Fed Chair Janet Yellen.

- 03/20 Neel Kashkari (the lone dissenting vote) and Charles Evans

- 03/21 Esther George, Loretta Mester and Eric Rosengren

- 03/23 Janet Yellan, Robert Kaplan

- 03/24 James Bullard and John Williams

2) Across the Pond: The biggest news is that Great Britain will officially start Article 50 on March 29th which will finally start the divorce process from the Eurozone and allow Great Brittan to nail down some new trade agreements. However, this creates a lot of uncertainty as it has never happened before. Great Britain will no doubt end up fine but the concern is about the health and stability of the Eurozone.

There is a Eurozone Finance Ministers meeting this week which will be closely watched as well as the French elections taking center stage with the first Presidential debate on Monday.

We also have heady economic data from China, Germany, Japan and several other of the top ten economic (in terms of GDP) that will hit.

3) Domestic: We have a very light economic calendar this week and there are no Treasury auctions to digest. The only economic report of any significance is Friday’sDurable Goods Orders.

This Week’s Potential Volatility: Average

Look for mortgage rates to stay in a pretty tight range this week. The one thing that can move mortgage rates out of the range are comments from Janet Yelen on Wednesday.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.