Weekly Mortgage Rate Update (March 13th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

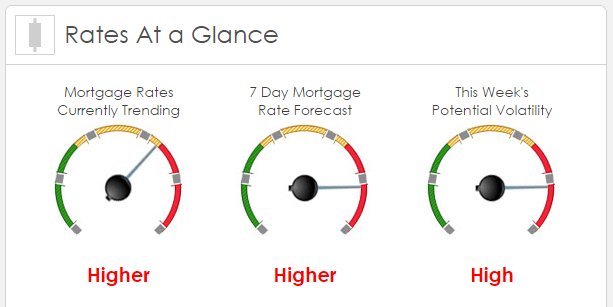

Rates Currently Trending: Higher

Mortgage rates are trending higher this morning. Last week the MBS market worsened by -71bps. This was enough to worsen mortgage rates or fees. Overall the volatility for the week was high.

This Week's Rate Forecast: Higher

Three Things: These are the three areas that have the greatest ability to directly impact mortgage rates this week. 1) Fed, 2) Across the Pond and 3) Domestic.

1) Fed: The much-anticipated March FOMC meeting will conclude Wednesday at 2:00 PM EST. The Fed has done everything that it could over the past month to move the markets to expect a rate hike. Assuming that they do raise rates a 1/4 point, there’s still a lot that they can do to impact mortgage rates. First, this meeting we get their economic projections which contain the famous “dot plot chart”. This chart showed at least 3 rate hikes in 2017 the last time it was released but it took until last week for the market to finally believe them. Will this new dot plot chart show 4 hikes? Will it show more in 2018?

Also, we get a live press conference with Fed Chair Janet Yellen and her responses to live questions can really move pricing. MBS will also be EXTREMELY sensitive to any discussion or mention of the FOMC looking into or considering a time line to slow the rate of MBS purchases.

2) Across the Pond: We have several key events that can impact demand for our MBS. Just one day after our FOMC has their moment in the sun, we get the Bank of Japan’s Central Bank rate decision and policy statement. They currently have a negative rate (-0.10), will they move that back to at least zero? A few of their members have already suggested slowing the pace of (tapering) their QE. We also get very key economic releases out of China (Retail Sales, Industrial Production), Germany (CPI) Eurozone (CPI, Unemployment), and Great Brittan will have their Central Bank interest rate and policy statement as well.

3) Domestic: We have a very large plate of heady economic data to absorb this week with Retail Sales, Inflation (PPI and CPI), Manufacturing data (Empire, Philly Fed, Industrial Production) and Consumer Confidence.

There are no major Treasury auctions this week, but they haven’t influenced MBS in a while anyway.

Oil will continue to be closely watched as the slide below $50 has actually helped mortgage rates, meaning MBS would have sold off even more if it were not for falling WTI Oil prices last week.

This Week's Potential Volatility: High

Mortgage rates have a high probability of being very volatile this week with all the big events denoted above. While the market has a rate increase already priced in, we could see significant mortgage rate volatility tied to Janet Yellen’s comments on Wednesday.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.