Weekly Rate Mortgage Update (June 26th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

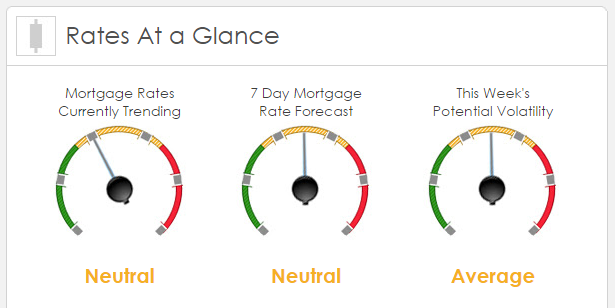

Rates Currently Trending: Neutral

Mortgage rates are trending slightly lower so far today. Last week the MBS market improved by +16 bps. This may’ve been enough to slightly improve mortgage rates or fees. Mortgage rates experienced very low volatility throughout the week.

This Week's Rate Forecast: Neutral

Three Things: These are the three areas that have the greatest ability to impact mortgage rates this week: 1) Geopolitical, 2) Fed and 3) Domestic.

1.) Geopolitical: Across the pond, we have Theresa May teaming up with Northern Ireland to have the support she needs to stay in power and continue with Brexit negotiations which began last week. President Trump is meeting with the leader of India today to discuss trade, but the market focus is on the Senate as they attempt to vote on health care reform this week.

2.) Fed: There is no question that the Fed’s last statement was hawkish and points to another hike this year as well as fewer MBS purchases. But the bond market simply hasn’t come around to buying into that as a real possibility yet particularly given the recent bout of economic data. So, we will continue to pay very close attention to their speeches to see if they begin to shift market sentiment:

- 06/26 John Williams

- 06/27 John Williams, Patrick Harker, Janet Yellen and Neel Kashkari

- 06/29 James Bullard

3.) Domestic: We have a big week for economic data with some big name reports that have the ability to move the needle for mortgage rates. The most important one is Friday’s PCE report which is what the Fed uses as their official inflation gauge. We also have Durable Goods, Chicago PMI, Consumer Confidence and the final revision to the 1st QTR GDP.

Treasury Auctions:

- 06/26 2 year note

- 06/27 5 year note

- 06/28 7 year note

This Week's Potential Volatility: Average

A very pivotal week. We have been trading in a very well defined channel for the past two weeks. We actually have an opportunity to break out of that channel for worse mortgage rates this week. That momentum lower can only come from the passage of the Health Care reform in the Senate. IF it is not passed, then we will stay in our current channel.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.