Weekly Mortgage Rate Update (June 19th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

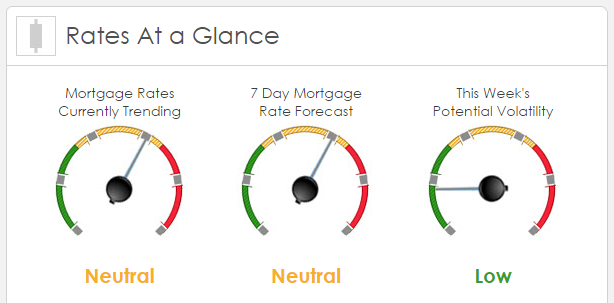

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +13bps. This caused mortgage rates to move sideways for the week.

This Week's Rate Forecast: Neutral

Three Things: These are the three areas that have the greatest ability to impact mortgage rates this week: 1) Fed, 2) Geopolitical Events and 3) Across the Pond.

1) Fed: The bond market has effectively ignored a surprisingly more “hawkish” tone last week. But this week we get a barrage of Fed officials, and we will be paying close attention to their messages.

- 06/19 William Dudley and Charles Evans

- 06/20 Stanley Fischer, Eric Rosengren and Robert Kaplan

- 06/23 William Dudley, James Bullard, Loretta Mester and Jerome Powell.

2) Geopolitical Events: Brexit talks between Great Brittan and EU members started officially today and comments/details out of the negotiations could have an impact on how traders view growth prospects in the EU. The markets will also react to any progress with health care in the Senate and tax reform through the House as well as new developments in the Russia/Trump “investigation.” We have conflicting reports from both media and state department sources if there even is an investigation (other than in Congress) by the FBI, etc.

3) Across the Pond: While we have a lot of housing news to digest this week, there are no domestic economic releases that have the gravitas to move the needle for mortgage rates. The bond market will be focusing on overseas economic data this week:

- Japan (number 3 economy): Minutes from last week’s BoJ meeting, Nikkei Manufacturing PMI.

- Germany (number 4 economy): PPI and an important 30-year bond auction, PMI.

- ECB: Non-Monetary ECB Policy meeting, Consumer Confidence, PMI

This Week's Potential Volatility: Low

We had a lot of choppiness last week (62BPS swing from our highs to our lows) but in the end, MBS really just moved sideways. This week, look for MBS to once again move sideways but without the choppiness (flat mortgage rates).

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.